🍿 Techonomics #15: What Quibi Really Got Wrong, Mainstream Crypto, and Keeping the Internet "On"

What I know about building consumer products; Crypto finding its way; and Protecting the Internet from its biggest fan

Welcome to Techonomics

I’m Jake and welcome to our 15th week of technology industry analysis. We now have over 2,450 subscribers, up 250 from last week, who get this newsletter delivered directly to their inbox weekly. Thank you for all of the support, and please spread the word!

This week

This week we are back with a Longer Take on the Quibi snafu through the lens of what I know about building consumer technology products. I am really excited to deep-dive on the major misstep on their journey from hype to shutdown. Check it out.

First time readers

Techonomics is a weekly newsletter exploring the intersection of technology, business, and the economy from an engineer’s point of view. We will deep-dive into tech industry news, including niche news that may fly under the radar. Content and commentary to help make sense of the technology sector.

Also, take a dive into a few of my previous essays to get a sense of what you’ll find week after week:

- 🏭 What's in a chip? Breaking down the Semiconductor Industry

- 👩⚖️ Section 230, the Senate, and Understanding the Internet

- 🍪 Upending the Internet’s Free Business Model

- 💸 Productization & Platforms

- 🇦🇺 Australia vs the Aggregators

- 📊 Software IPOs and S-1s: playing with numbers

Enjoy!

— Jake

🍿 Thoughts on Quibi and Consumer Product (link)

Why they missed out on what's most important for consumer tech products.

For those following tech news, specifically the streaming wars, it’s likely that you have heard that Quibi, the short-form mobile-first content streaming service that sits somewhere in the middle of Netflix, TikTok, and YouTube, is being shutdown after only being live for 6 months and taking on nearly $2 billion dollars of investment from tech VC, media, bank, and private equity investors ranging from JP Morgan to Lionsgate to Google. From that investment, Quibi plans to sell for parts and give back $350 million to initial investors ($). Not exactly the Cinderella story for a company with a once sky-high valuation with investor money to boot.

This is pretty enticing news. There have been a lot of articles, op-eds, and analysis done of this debacle of this tech and media unicorn that raised that large sum of money prior to launching anything. Lots of these opinions, including this analysis, are in retrospect. Being aware of that is important. Even so, the value of looking at what happened to Quibi through the lens of consumer software, venture capital, and what it takes to be successful in a market is helpful to remind us how to assess future hype and potential investments. Let’s dive in.

Visual of the week

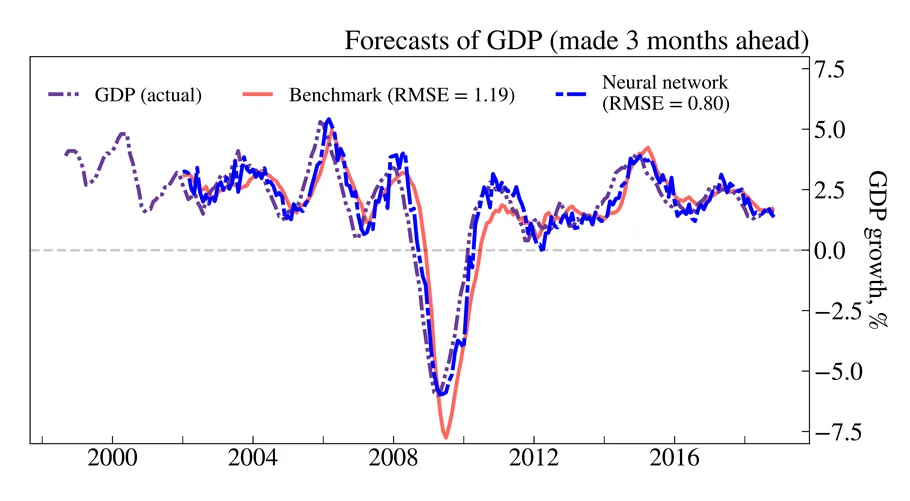

☀️ Macroeconomic forecasting with ML: Researchers used Machine Learning and sentiment analysis to forecast GDP three months ahead from the news, specifically The Daily Mail. As we get better and better at predictive data analysis we will start seeing a shift in the predictive behavior of policy makers, traders, and every day consumers. That alone will change behavior, and the cycle will continue as the models continue to train themselves. (link)

Interesting reads

🔏 Searching for an answer: The DOJ filed the long-awaited antitrust suit against Google last week. I was surprised to see that they didn’t go after more of the ads business or their Chrome browser, which is what I had thought in previous Techonomics writing. Instead, they went for their search business, and how Google used anticompetitive tying arrangements with companies like Apple to make themselves the default search engine on mobile and preyed on user behavior:

For a general search engine, by far the most effective means of distribution is to be the preset default general search engine for mobile and computer search access points. Even Where users can change the default, they rarely do. This leaves the preset default general search engine with de facto exclusivity. As Google itself has recognized, this is particularly true on mobile devices, where defaults are especially sticky.

The DOJ went for anti competitive practices which propelled Google to dominance. There have been a lot of great analyses on this topic ranging from proponents to those who think that buying a default position as a search provider in Apple’s iOS isn’t anticompetitive. I believe it’s a strong case as it brings into the discussion a subjective matter of if something is tying or not, but is out-bidding another company for a billboard in Times Square considered anti competitive? On the contrary, but the internet doesn’t understand physical bounds and if there’s fear of a monopoly, they need to rewrite the rules. (link)

🤑 Mainstream crypto: PayPal this week announced that they would allow their customers to hold cryptocurrency, like Bitcoin, in their online wallet and shop with them. The merchants themselves will only see fiat money like the US dollar, and PayPal will take care of any conversion and service fees on their end. Pretty genius move, and one of the first majorly scaled uses of cryptocurrency in a major online payments player. This will be a great test to see how well cryptocurrency is adopted for something other than a store-of-value. (link)

🚙 Tesla’s Test: Tesla released it’s ‘self-driving’ capability called FSD (Full Self-Driving) Beta to begin testing with real drivers in real Tesla’s on real roads. There’s a lot of uncertainty in the market about if the technology is ready for it, mainly because some of the tech that Elon is relying on can’t quite capture shapes and depth the same way Lidar can. While I typically am an advocate for testing something and getting it out early, this feels early. The only saving grace is that the headlines are hyping up the tech when it still needs a human driver. (link)

🌍 Keeping the lights on: A pair of Congressmen have introduced a bipartisan bill to limit the executive branch’s presidential power to shut down the internet. I was a bit shocked to type that sentence, but given that the decentralized internet has become so integral to the global society and the recent world uncertainty, it’s a refreshing take on the protection of a right we all take for granted right now. (link)

Bites

© Real life copy-paste: a good friend of mine shared a pretty awesome product with me this week. How would you like to copy and paste real life from your camera? (link)

🦾 Service sector robots: cool showcase video of a robot stocking shelves while being controlled by someone in VR. Is this the future? (link)

🧠 Trip down tech’s memory lane: The biggest tech flops of the last decade will have you thinking. (link)

♠️ The surest of risky bets: Money is moving from smaller startups to late stage companies. (link)

🍸 The real James Bond? Files found in Warsaw, Poland may have the answer. (link $)

🌚 Moon water: NASA Scientists confirmed the presence of water on the moon. No need for a clever headline for that. (link)

Follow-ups

🖥 Intel’s woes and IDMs: Two weeks ago we took a look at the semiconductor industry in 🏭 What's in a chip? Breaking down the Semiconductor Industry and came to the conclusion that the industry is changing. Large IDMs (vertically integrated) companies like Intel will likely split their manufacturing business from their chip design business, either maintaining both under a parent company or specializing within one of the two areas. This seems obvious, but it’s a great departure from how the industry IDMs were dominant due to vertical efficiency, and it’s starting to take shape.

Last week, Intel announced that it was going to sell its memory manufacturing business to SF Hynix ($) given lower margins on the decreasing price of memory chips. This further consolidates the memory chip market with 20% to Hynix and 30% share with Samsung. At the same time, Intel is trying to focus more on the high margin markets of 5G and GPU processing for AI. They’ve got a lot of catching up to do there based on the incumbents like NVIDIA and AMD, but it’s the best specialization play they have in order to stay afloat. (link $)

🚀 Race to space: Richard Branson is looking for $200 million for his Virgin Galactic space company looking to change the way we think about space tourism and launching satellites into orbit on short notice. Two weeks ago, we talked about how space is getting cheaper and cheaper on a per kilo basis, and while we aren’t there yet, Mr. Branson wants to change that. (link $)

My essays

If you missed them above, check out essays from previous weeks:

- 🏭 What's in a chip? Breaking down the Semiconductor Industry

- 👩⚖️ Section 230, the Senate, and Understanding the Internet

- 🍪 Upending the Internet’s Free Business Model

- 💸 Productization & Platforms

- 🇦🇺 Australia vs the Aggregators

- 📊 Software IPOs and S-1s: playing with numbers

- 📡 Cable Companies and the Innovator’s Dilemma: Round 2

- 🙉 Tread not-so lightly: Antitrust & Corporate Venture Capital

- 🛍 CFCs, urban warehouses, and the last mile

- 🤖 Big Tech and Antitrust: The Capitalism Paradox

- 🎵 The Music Industry's Profit Journey

See you next week!

Disclaimer (full)

Views expressed in “content” (including posts, podcasts, videos) linked to or created in this newsletter, website, posts, or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of any person, company, or entity I am affiliated with or each entities’ respective affiliates. The content is not directed to any investors or potential investors, and does not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.