🍪 Upending the Internet’s Free Business Model

Why recent changes to foundational technology tools for ads tracking will change the internet.

The internet is changing. If you’re following technology news, you know there are stories on Big Tech, US antitrust, DOJ cases, international regulation, government intervention, international acquisitions, national security, and the pressure to change up the 30% App Store tax. That’s just a select few, but pick any of those stories and you can get the sense that we aren’t in Kansas anymore.

One thread in particular is sliding under the radar and has an immense impact on the foundation of a traditional internet business model. I am talking about the trend to improve internet consumer privacy by removing the ability to track you across the web and mobile apps.

Earlier this year, Apple introduced full blocking of third-party cookies by default in their Safari browser. Google announced that the same functionality will be available in their Chrome browser in 2022. Other browsers like Mozilla’s Firefox also followed suit. This is a huge win for consumer privacy and security. These are the tools companies use to track your every move. To not have your every move tracked on the web through this open channel means that you won’t necessarily get served an ad about Carnival’s Jamaica cruise on Facebook after researching a potential vacation.

To make matters more interesting, Apple announced that with their iOS 14 release, all Apple devices running iOS would require opt-in for another very important identifier used by the ad networks. It is called the IDFA, or Identification for Advertisers, which allows other apps on your iPhone to track what apps you have used, what ad campaigns you’ve tapped on, and map your activity to internal data to serve you personalized ads.

This would have been another huge win, but Apple postponed the change until early next year to give developers more time to adjust accordingly to new flows prompting all of us to allow this tracking, and likely to avoid public scrutiny by the likes of Facebook. Why?

Diminishing returns

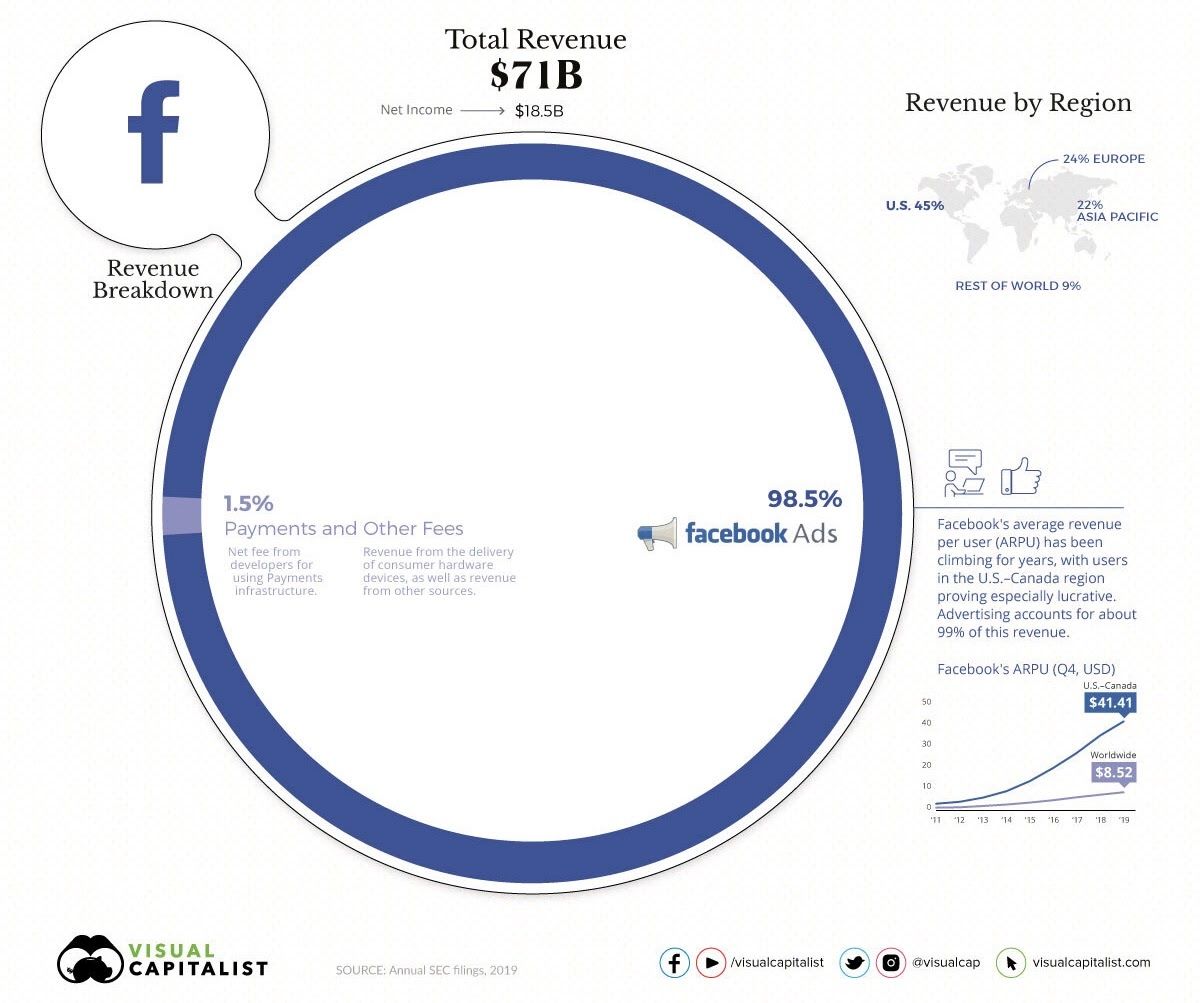

The reason why businesses that run on ads, like Facebook, pushed back on the Apple IDFA change, and why they aren’t happy with the broader trend to lock down foundational tools that have gone unchanged for years, like third-party cookies, is because they will be flying blind on their key business: ads.

If Facebook can’t have the same level of data on you or I through our browsing activity outside of their platforms, they have a more limited dataset to correlate your interests to your activities. Because of this, they can’t target ads as effectively. What happens when they can’t target ads as effectively? The value of the ad decreases.

In fact, the value of ads targeted to Apple’s Safari users diminished by a whopping 60% ($) when Apple introduced the changes to third-party cookies, the tool most used by advertisers to track activity. This meant that Safari user data became less accurate, and as a result, Safari users in ad auctions were no longer sought after. Lowered demand made them cheap.

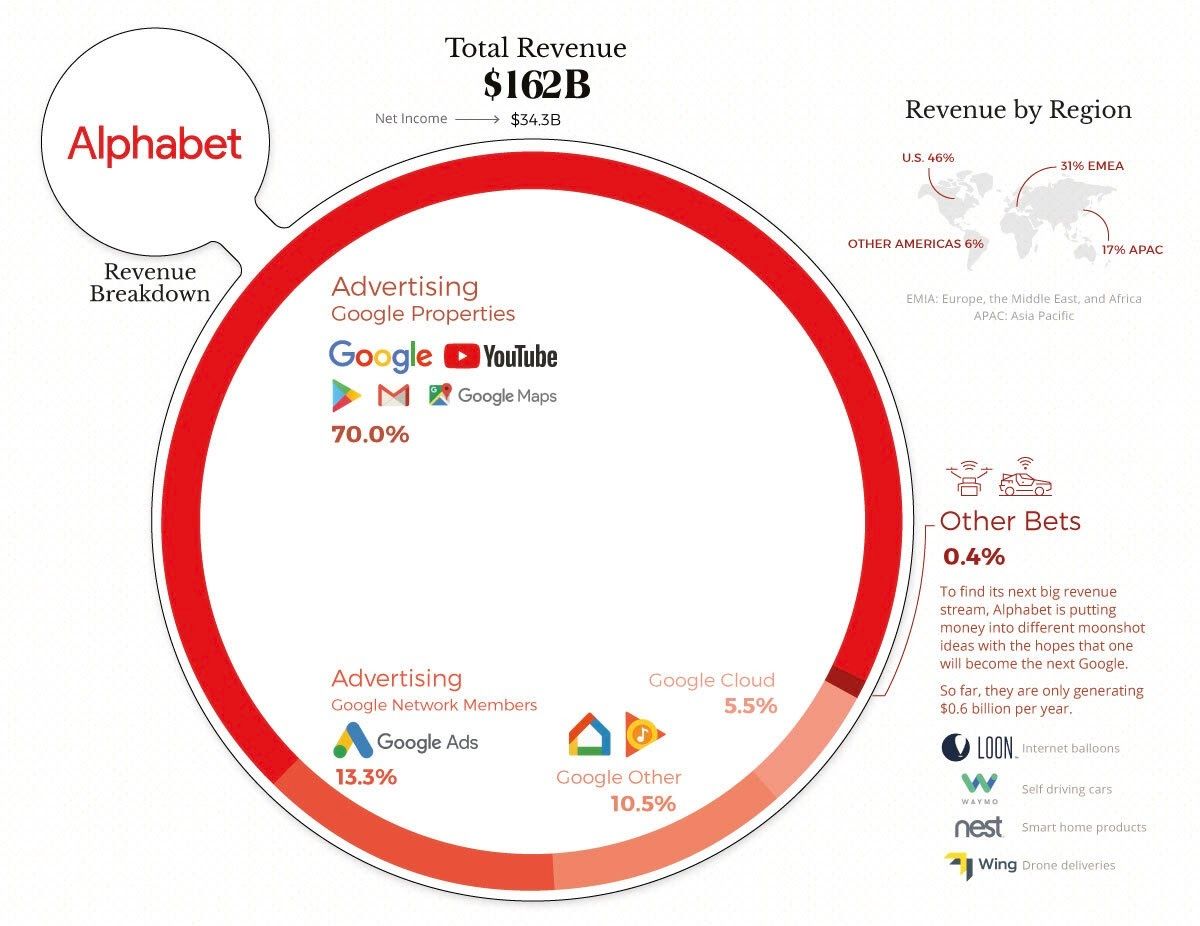

This is a clear sign of trouble for the ad business. With the continued decrease in the amount of third-party cookie and IDFA data available to advertisers will continue to decrease the value of internet advertising as a whole. Without your browsing history, it’s hard to send you timely advertisements that might just convert your activity to a sale. This is going to be extremely upsetting to platforms like Facebook and Google who’s ad revenue accounts for 98.5% and 84% of each company’s total, respectively.

With these numbers, you’d think that these businesses would crumble, but the changes might, as most changes do, impact Big Tech competitors and businesses that rely on these ad platforms disproportionately. Think competing advertising platforms, other social networks, small and medium sized business owners, publishers, and other advertisers.

Industry vs. privacy

Before we dive into why that might be, it’s important to understand why Mozilla, Apple, and Google are making this trade-off for consumer privacy. Truth is, it’s for different reasons across the board that just so happen to spin on the thread of consumer privacy.

Mozilla has always been known as an activist non-profit with a privacy and user centric point of view with an incentive to help the user, not the companies who are tracking you. You have control over the browser you pick as a user, and if you have control over that browser, you are going to pick the one that a) works the best, b) has better privacy controls, or, for an engineer, c) has a better developer experience. They hit all three and make money off of royalties from companies who are featured as Mozilla’s default search engine (i.e. Google or Bing).

Apple, as you all know, is a hardware and software services company focused deeply on the customer’s product experience. They sell high-end hardware and expensive software services that are vertically integrated into their closed platform, from which they generate a massive amount of revenue. They don’t have much of an ad platform presence. As such, Apple tends to push for more user control and a quality bar for the app experiences third-party developers put in the App Store. Even today you can opt-out of the IDFA using an option in settings. They can do this because their platforms won’t get hurt, but become more sought after as they support privacy incentives. Their platform ads are few and far between, and mainly are used within Apple’s own products like App Store search. Users know this and many are starting to put an Apple priced price tag on their privacy. This also so happens to help Apple reduce scrutiny in antitrust allegations behind the best-for-our-users guise.

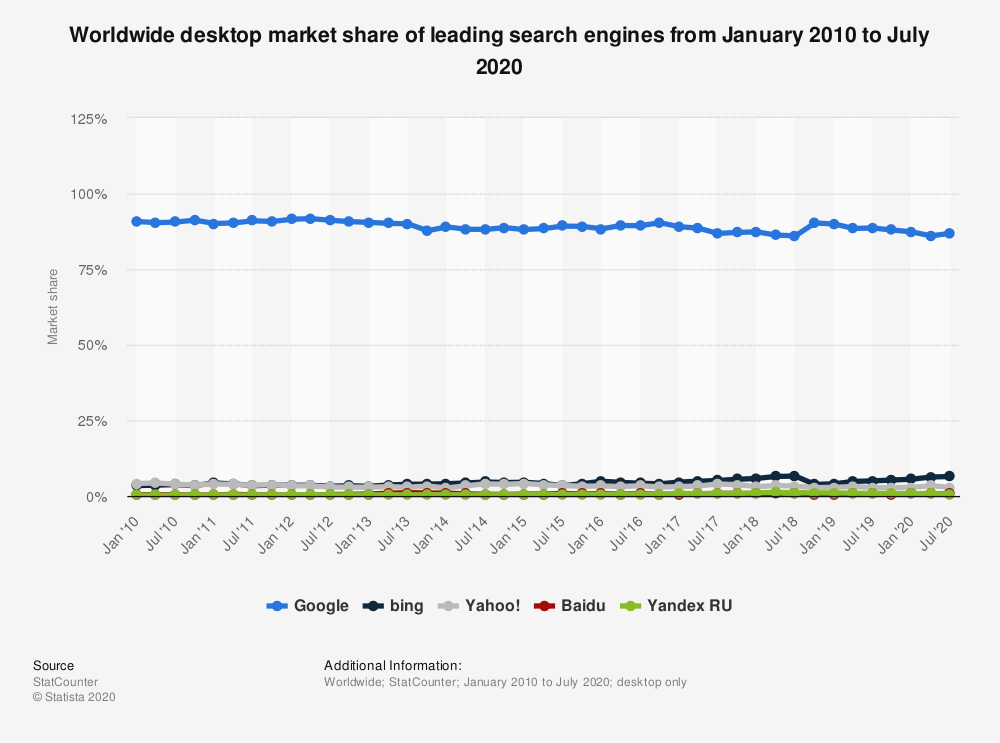

Google on the other hand is interesting given that such a large part of their revenue flows from their ads business. It’s probably the reason they need until 2022 to change their third-party cookie tracking. It’s unlikely that they will fully turn this off, but given they are under the regulatory and antitrust microscope, they need to open the release valve a bit and show that they are helping consumer privacy as they take ~90% of the search space.

Each of these companies is incentivized in a different way to bolster user privacy. It’s not just an activist measure, but rooted in deeply complex user behavior and incentive structures based on their product offerings or market position.

Big tech will be ok

Back to our discussion on business impact for Facebook, Google, and the industry as a whole. Why is the trend towards user privacy and the recent changes to third-party cookies and the IDFA going to hurt the little guy?

We give our data to Facebook and Google’s platforms everyday just through using them.

It’s true that the Facebook Audience Network and Google’s AdSense will be hit by this change, and that’s the largest reason Facebook is pushing back on the IDFA change and Google is slow to roll out changes on Chrome. They will have a harder time tracking you across third-party web pages and apps with the new changes to cookies and the IDFA. This is where they are truly flying blind. Facebook’s looking at a 50% drop in value of Audience Network ads for developers and Google’s AdSense business will be hit, but these network ads are only a small portion of their overall ad business. Most revenue comes from ads served in their products.

These Big Tech companies are smart. They know how to leverage your attention and action with free products. They use these free products to gather data. The more you stay on Google products like Gmail, YouTube, Search, and even your Google Home, the more Google knows about you as a consumer. The same holds for Facebook. Whether you are on Facebook proper, Instagram, or are using your Facebook Portal, Facebook is gathering data on you. Data that doesn’t rely on third party cookies or IDFAs.

So who takes the brunt of these changes?

First, if ad platform competitors that rely on these tools to increase the value of their company offerings are now unable to support their own ad platforms with personalized ads, then they are either going to need to find an alternative to ad personalization, figure out an alternate data source, or they’ll need to fold.

Second, if publishers or small businesses who are looking to advertise need access to personalized ads and consumer data to market their businesses, they’ll need to turn to where that data lives: Facebook, Google, and other major technology platforms. If they need to turn to these companies as the continued major source of marketing and advertising, then the demand will increase on these platforms when the supply of ad positions remains the same, driving up the price of on-platform advertising.

Lastly, smaller, independent, or developer run businesses that work for free solely through ad revenue will likely see their ad revenues fall. They rely on Facebook Audience Network and Google’s AdSense. Remember that if the ad is personalized, there’s a better chance of a click-through and conversion. If it’s not personalized, the value of the ad decreases, and so does the value of the impression or click… and the revenue for whoever is hosting the ad.

Third-party cookies and the IDFA may be no-more, but the need to advertise and monetize will continue for other companies in the industry. Companies are now going to need to pay Big Tech platforms for their data and eyeballs to drive marketing campaigns that have better conversion rates due to their data and personalization. Increased demand for better conversions will continue to drive money and power to the platforms.

Upending internet foundations

As we bolster consumer privacy, the removal of foundational web tools that have propped up a key part of the internet business model is going to shift the way we think about internet monetization. We are used to an internet where things are free. Free because we pay with our data and our attention to advertisements. Inverse to an insurance policy, these companies serve ads to all of us in the hopes that one of us might click through and drive traffic to their customers. They get paid as a result. Now a little less.

The value of ads themselves will inherently decrease if personalization isn’t taken care of. Does this mean that advertising will fully go away? Of course not. We still have billboards and newspaper ads because there’s still enough data flying around to get a sense of who might be looking or clicking. However, as the value of those ads will go down there may be a migration from the current model to one that can support the ad personalization and conversion rates we are currently used to without the data we are used to sharing.

That new world looks like it may be more of a paid internet. The advent of newsletters, like the one you likely found this article through, is just one clear example of the acceleration of the trend from a free to a paid internet. I choose not to have a platform with a ton of ads because, well, that would suck for the reader, but now if I even wanted to, it’s unlikely that I would make the same revenue I had in the past based on click through rate.

Ad-supported businesses will no longer be what they once were and the ads you buy will continue to be served on the major platforms like Facebook and Google Search. These businesses will have to find another way to survive, and that’s providing enough value to make you pay. Perhaps it’s not a bad thing after all.