🇦🇺 Australia vs the Aggregators

Australia, media outlets, and egregious regulation for Facebook and Google

Recently there’s been a flurry of ill-informed and brash regulation proposals related to technology companies.

- Scooter companies like Bird were almost liable for all accidents

- Uber and Lyft were going to shut down in California under a ruling of drivers as full-time employees

- Australian regulators created a code requiring Google and Facebook to haggle with news outlets over paid content

On the heels of the US antitrust hearings, it isn’t a new pattern: regulators seeking to improve consumer and company rights against big tech.

Regulation has merit, as we talked about in Big Tech and Antitrust: The Capitalism Paradox. However, regulators need to deeply understand the impact of rulings prior to instating them.

Either government supported regulators are naive and don’t understand market economics, they are subject to heavy lobbying, or both. Specifically in the Australia example.

Australia’s proposal absurdity

In April, the Australian Competition and Consumer Commission (ACCC) was tasked with putting together a draft code (law/regulation) to address a bargaining power imbalance between big tech and Australian media outlets. Facebook and Google to be exact.

Late last month, they did and released the draft code to the public. So, what is the code? Let’s take a quick look at the FAQ.

What is the news media and digital platforms bargaining code?

The draft code would allow news media businesses to bargain individually or collectively with Google and Facebook over payment for the inclusion of news on their services.

The code also includes a set of ‘minimum standards’ for the treatment of news on digital platform services, addressing issues such as:

Ok. From this we know the code is supposed to bolster the bargaining power of Australian news outlets against Facebook and Google so that the media outlets can get paid for content distributed by those companies. There’s also some control and visibility aspects.

Why is this code necessary?

The code seeks to address the fundamental bargaining power imbalance between Australian news media businesses and major digital platforms. This imbalance has resulted in news media businesses accepting less favourable terms for the inclusion of news on digital platform services than they would otherwise agree to.

Less favorable terms is a bit vague here, but I am reading this as the media outlets in Australia feel entitled to the money that Facebook and Google are making.

Which digital platform services would be included in arbitration? Why does the code’s final offer arbitration only apply to these services?

- Facebook: Facebook News Feed (including Facebook Groups and Facebook Pages); Instagram; and Facebook News Tab (when launched in Australia).

- Google: Google Search; Google News; and Google Discover

- These services have been selected on the basis that they display Australian news, without typically offering revenue-sharing arrangements to all news media businesses that produce this content.

Interestingly, these products are free for consumers, have controls to prevent content from being used if desired (Facebook and Google), and most of the time, drive traffic directly to those media outlets for free. Yes. Free distribution.

Also, the definition of content is important. Facebook and Google, and the rest of the internet for that matter, all leverage links with metadata attached to them to create a web where one link leads to another. This is how the internet works. Metadata isn’t the content. It describes the content. Facebook and Google, for the most part, show metadata only, before driving their users to the website of the media outlet for free.

What are the minimum standards under the code and why are they necessary?

In addition to the obligation to bargain in good faith, the draft code introduces a series of ‘minimum standards’ for digital platforms to meet in their dealings with news media businesses. These would require digital platforms to:

give news media businesses at least 28 days’ notice of:

algorithm changes likely to materially affect referral traffic to news;

algorithm changes designed to affect ranking of news behind paywalls; and

substantial changes to display and presentation of news, and advertising directly associated with news, on digital platform services;

give news media businesses clear information about the nature and availability of user data collected through users’ interactions with news on their services;

publish proposals to appropriately recognise original news on their services;

provide flexible user comment moderation tools for news media businesses; and

allow news media businesses to prevent their news being included on any individual digital platform service.

These minimum standards reflect terms that Australian news media businesses may have been able to secure in commercial negotiations with major digital platforms in the absence of the existing significant bargaining power imbalance.

Ok, so this portion drives us to think visibility into the system is the main concern. Again, media outlets, and all website admins for that matter, actually do have control over the inclusion of their content on Facebook and Google. The ask to put process and regulation around algorithms and display is mostly fair, especially if they want to push power to media outlets. Be warned though, if the rules are clear, they can and will be exploited, and this needs to be accounted for.

More importantly, the last bullet is troubling. While Facebook and Google have power as aggregators of news content, these news media outlets are gaining free distribution. In order to understand this better, let’s look at aggregators as a concept.

Aggregators and power

Facebook and Google are aggregators. They are not the producers of content, you are. Each of us that uses their products or platforms contributes something back to the larger network, whether that’s a post on Facebook or your Wordpress site showing up on Google Search. In the internet age, these aggregators are also disruptors, but why?

Let’s look at Aggregation Theory by the author of Stratechery, Ben Thompson.

The value chain for any given consumer market is divided into three parts: suppliers, distributors, and consumers/users. The best way to make outsize profits in any of these markets is to either gain a horizontal monopoly in one of the three parts or to integrate two of the parts such that you have a competitive advantage in delivering a vertical solution. In the pre-Internet era the latter depended on controlling distribution.

For example, printed newspapers were the primary means of delivering content to consumers in a given geographic region, so newspapers integrated backwards into content creation (i.e. supplier) and earned outsized profits through the delivery of advertising. A similar dynamic existed in all kinds of industries, such as book publishers (distribution capabilities integrated with control of authors), video (broadcast availability integrated with purchasing content), taxis (dispatch capabilities integrated with medallions and car ownership), hotels (brand trust integrated with vacant rooms), and more. Note how the distributors in all of these industries integrated backwards into supply: there have always been far more users/consumers than suppliers, which means that in a world where transactions are costly owning the supplier relationship provides significantly more leverage.

The fundamental disruption of the Internet has been to turn this dynamic on its head. First, the Internet has made distribution (of digital goods) free, neutralizing the advantage that pre-Internet distributors leveraged to integrate with suppliers. Secondly, the Internet has made transaction costs zero, making it viable for a distributor to integrate forward with end users/consumers at scale.

The Aggregation Theory is well stated, and plays well into our analysis of the ACCC’s draft code. It shows a shift of power from pre-internet distributor and supplier relationship to an internet age with large scale aggregation and free distribution, exactly what the ACCC is trying to squash.

The crux and the value

Facebook and Google are large aggregators in the internet age. They are positioned well to take advantage of free distribution and zero cost transactions while managing an almost unlimited amount of supply.

So, if we look again, why does the Australian government want to make it easier for news outlets to negotiate terms?

It all comes down to money.

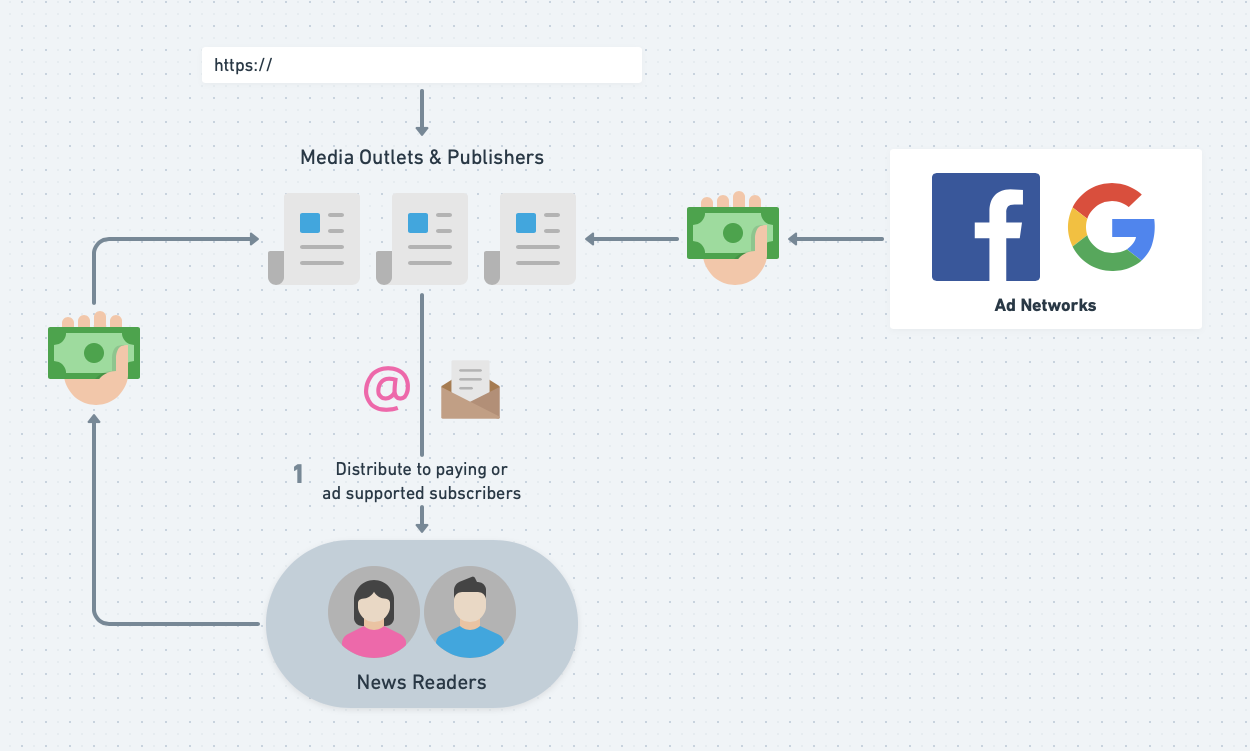

Facebook and Google make and have a lot of it. They make it by advertising; leveraging their large user scale, easy-to-use (and free) products, and network effects to keep people coming back. Consumers get something they enjoy for free (or more accurately, their data). Businesses get organic, free network distribution as well as the ability to distribute further to more consumers by using the consumer’s own data to advertise more effectively through ad targeting.

Facebook and Google also have dominated internet age distribution channels. The same distribution channels that media outlets once controlled as the vertical supplier of news content. Now that the media outlets are simply the supplier, and not the distributor, the advertising profits they once had in print news are no longer here. The value is in distribution and those profits now go to Facebook and Google.

When those profits get redistributed due to competition and market positioning, there’s bound to be lobbying from the less fortunate side. In this case, I can’t help but believe that news outlets through the work of high flying Australian news execs. I mainly say this because the legislation doesn’t make any sense for consumers. Let’s talk about that.

News aggregation now

Content used to go straight from the media outlet as the supplier, through their owned distribution channel, and onto the consumer. Now it goes through an internet age aggregator, unless there is a direct relationship through subscriptions and email. Additionally, in the case of Facebook, the supplier and distributor relationship now has an intermediary: the consumer.

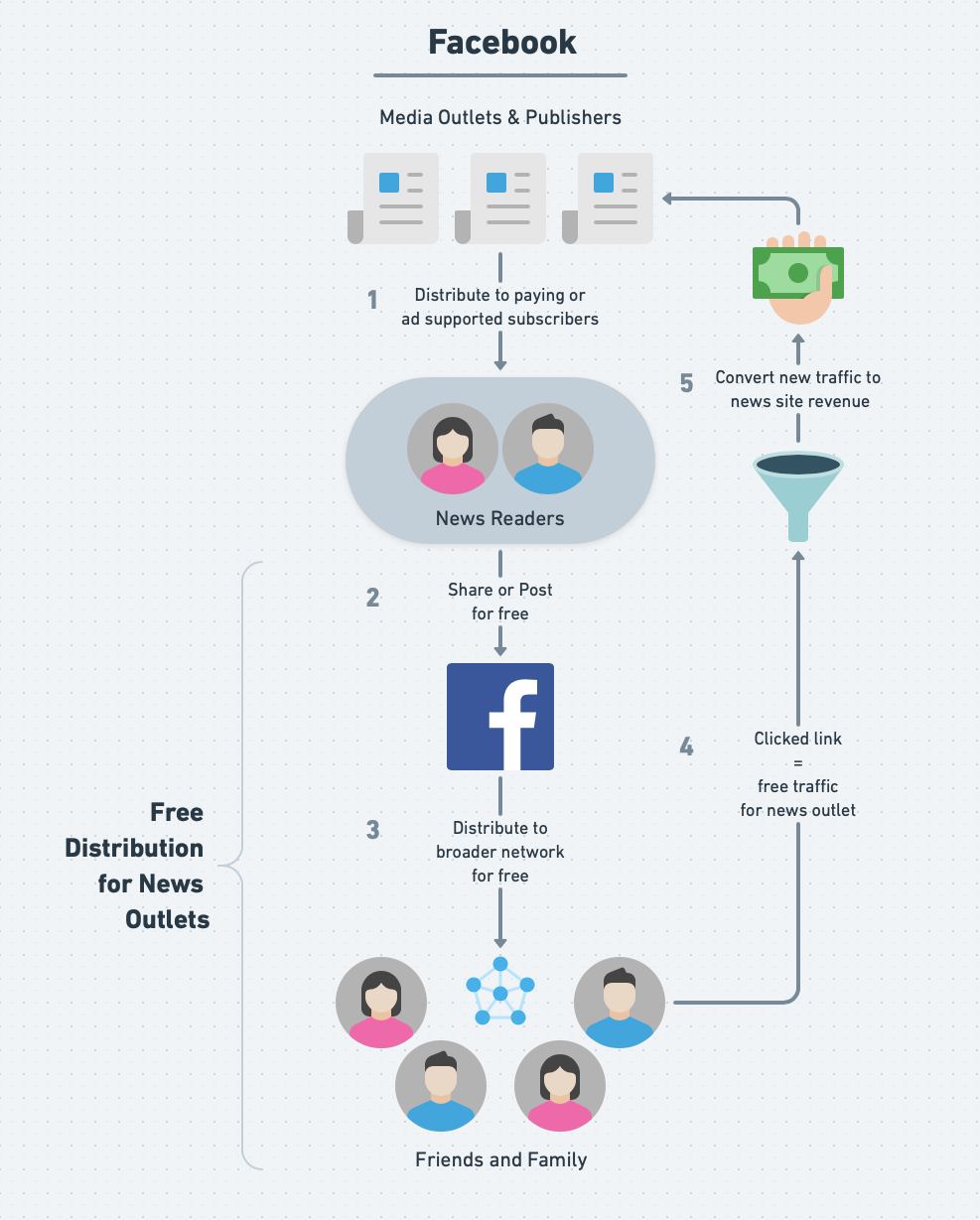

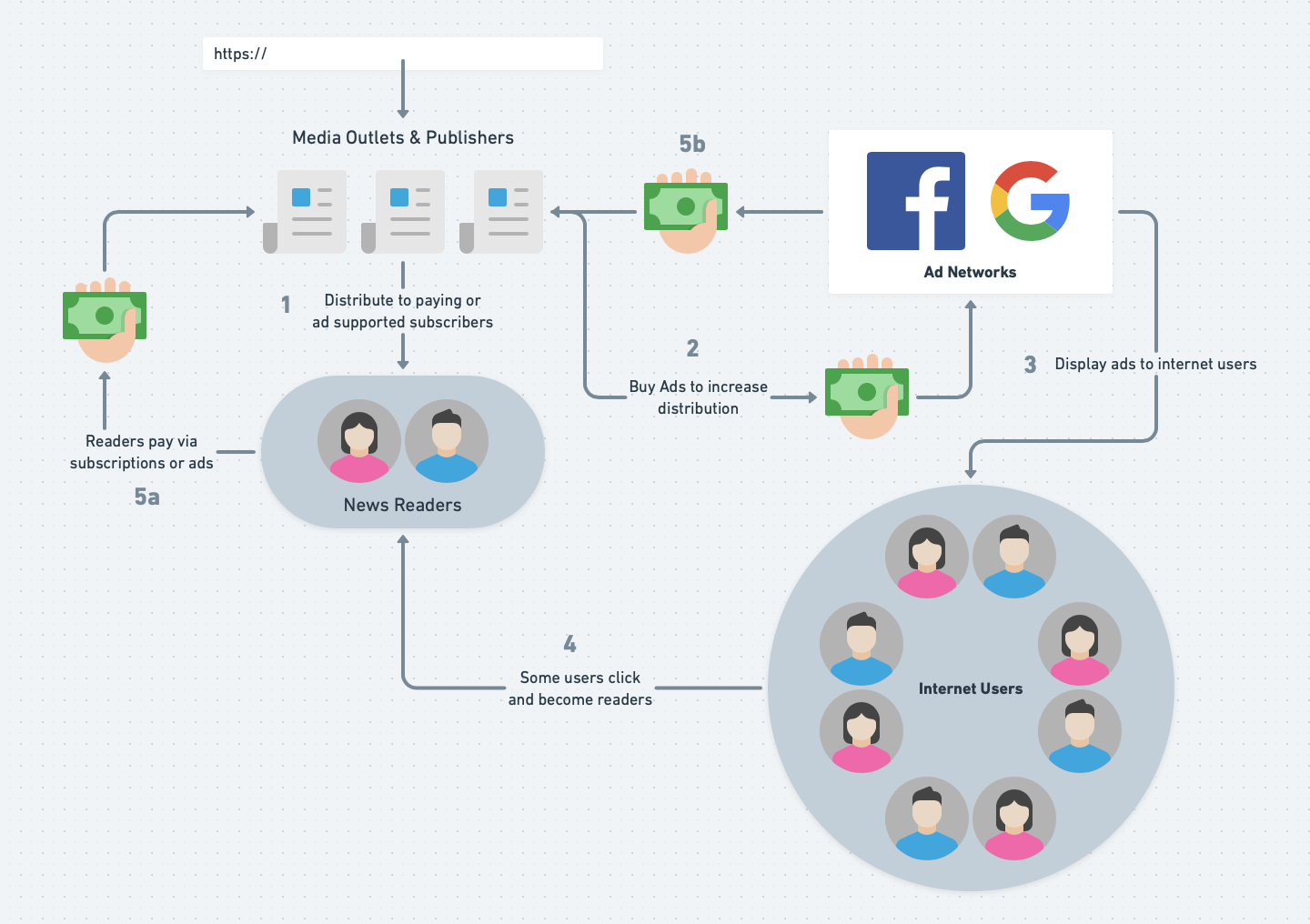

So let’s take a look at a diagram I put together and see how this works.

Simplifying this a bit, Facebook enables news content distribution in a few ways. The most prevalent is organic sharing. The second is Facebook News, which hasn’t even launched in Australia.

If you look above, you can see how the organic sharing method works. A user reads something on a news site, shares it on Facebook, Facebook distributes that content to the user’s network, and their network navigates to the news site. This is free distribution.

That free distribution to the media outlets site means that these companies have free traffic coming to their sites and into their conversion funnel. In this environment, an outlet can show ads, put up a paywall, or anything else to try and convert the reader to a paying subscriber.

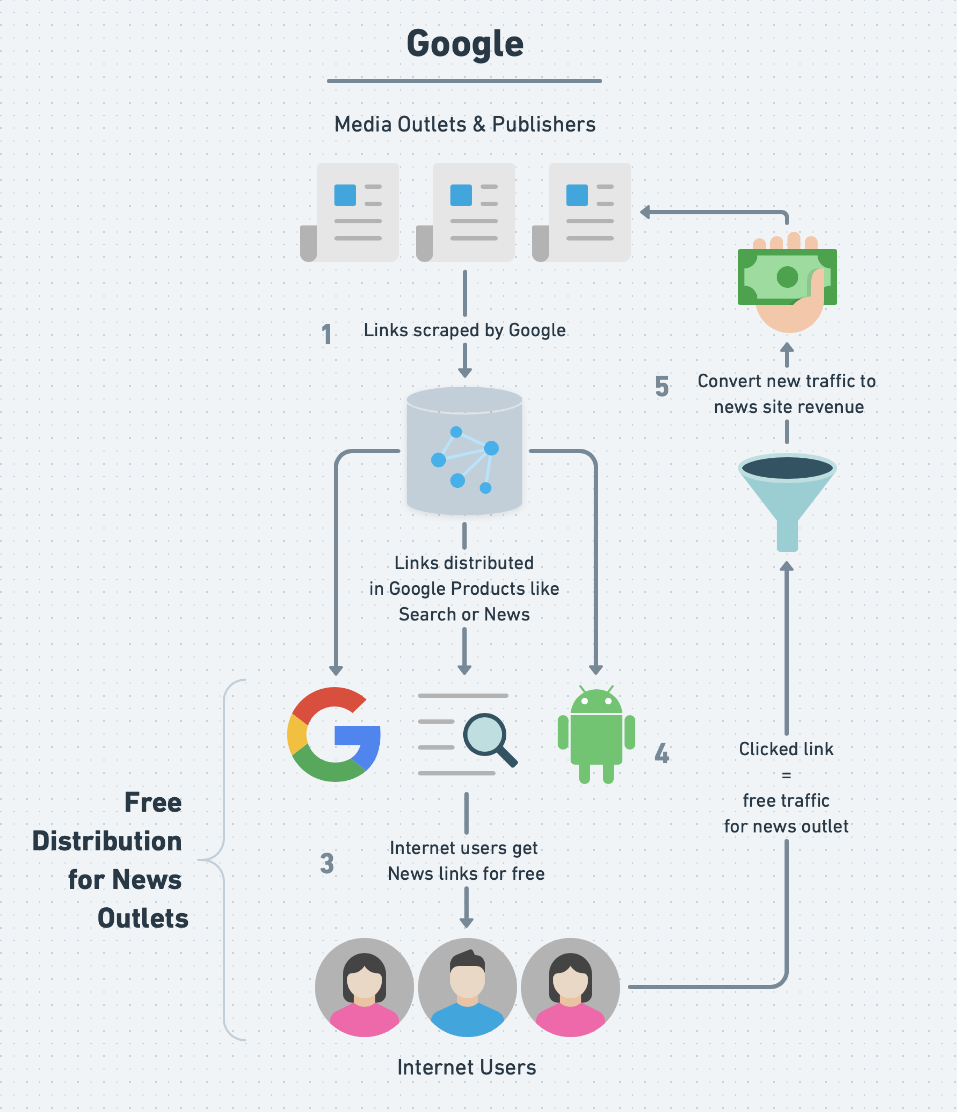

For Google, things are largely the same, but have slight differences that more closely resemble Facebook News, their second most prevalent way for Facebook to distribute news content.

Here you see that Google scrapes the web using their web crawler. They save those links and site provided metadata, and show those in Google Search. Additionally, a site can set up metadata in a way that it will get picked up by Google News, a Google product dedicated to the aggregation of news.

In both Google News and Facebook News, when you click an article, it brings you directly to the media outlets website. There you get the same free distribution you saw with the organic shares on Facebook. The new readers will enter your controlled website conversion funnel where they can set up the direct supplier/consumer relationship.

I can’t stress enough that in both of these examples the media outlets are getting free organic distribution from the aggregators. That is a direct supply of free traffic to their websites and users that enter their conversion funnel. If the news outlet has a solid conversion, they can bypass through direct relationships with their customers via email or push notifications.

Trying to make sense

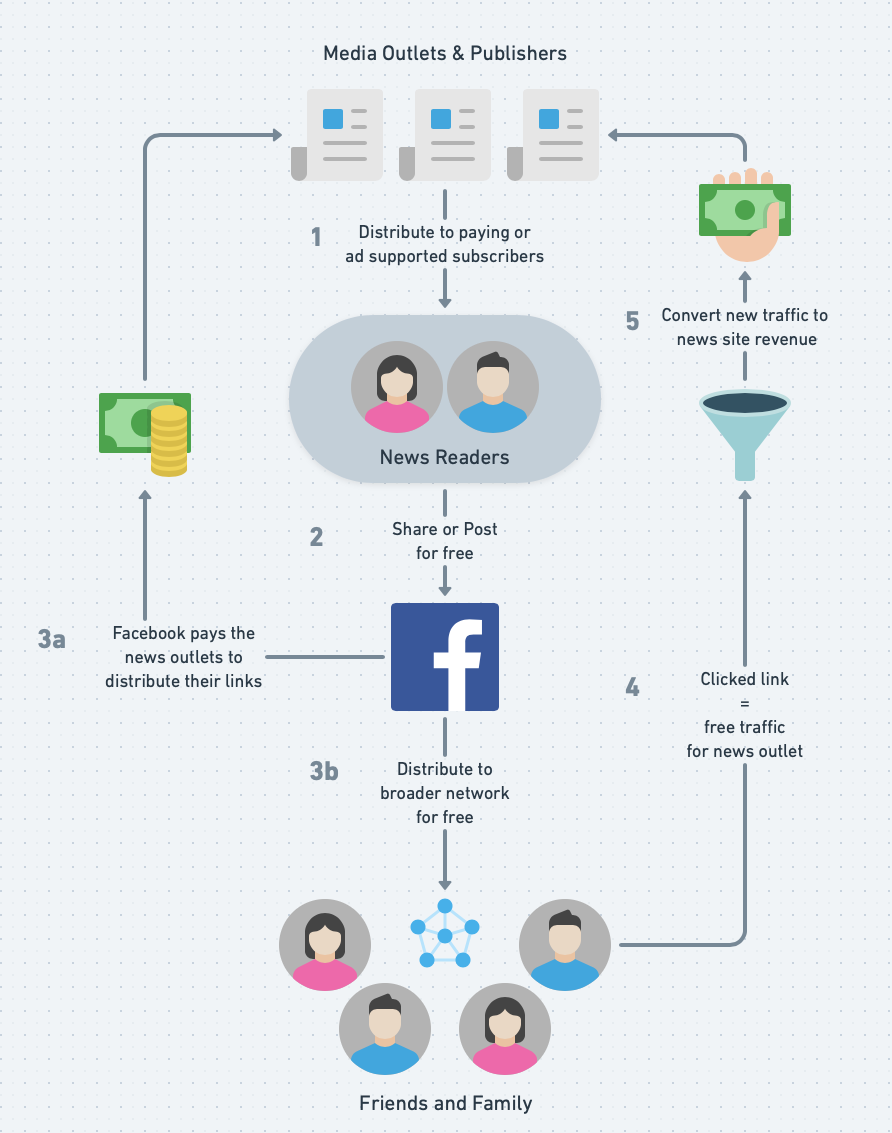

So what is the difference between the ACCC proposal and what you see above?

Cool. So media outlets now get paid out by Facebook (or Google) in step 3a to distribute content shared on their platforms to more of their users. This is illogical because if you recall from above, Facebook and Google aren’t showing news content in the majority of cases. They are showing news metadata like headlines and images. These link to the sites owned by the media outlets. Again, putting users in their conversion funnel. Media outlets should be paying for this distribution, not getting paid.

If you can get around that absurdity, charging aggregators to serve media outlet links to a broader network is difficult. In order for that to work, you would need to determine the value of a single user over time and the value they get out of a click into a news outlet or impression of news metadata. Also, the value would have to make Facebook and Google comply. I don’t see a smooth way on how to make that happen.

If there were product experiences that Google and Facebook wanted to release, similar to Apple News, that showed all of the news inline and had a nice controlled experience, then you could have some form of profit sharing. This would be similar to a Spotify model. Google even proposed this in June, but it’s now on pause because of this regulation.

So, of course there is a cut of money somewhere. It matters if the cut is the outcome of a free market, not regulation in this case. It’s awkward to have the aggregators pay for distribution of links. Why not just tax if you want the money instead of playing this arbitration game?

In any case, the likely outcome is that Facebook and Google pull their product offerings and shutdown news sharing. As we saw in 2014, Google shut down Google News in Spain due to similar regulation. Facebook is threatening to do the same this time around. Aggregators have the leverage.

Supply problems

What would it look like if Facebook and Google turned off the hose of free distribution to media outlets?

This may seem like a big hit to Facebook and Google. They now don’t have people distributing content through their platforms from the media outlets. However, it’s not going to have a large impact on these aggregators for two reasons: content supply on the internet is nearly limitless and they have advertising platforms.

Limitless Supply

Let’s take Techonomics as an example. In the world of the internet, there are independent authors, niche sites, and less well-known news outlets. I am an independent author. There are services that helped me get started writing with a built in distribution channel through my email list. It costs me nothing but my time. I need to grow the email list, sure, but that’s the point. I would love for more people to find value in my writing through discovering it on a channel like Facebook or Google.

Techonomics is a part of the limitless supply of content and news that democratizes access to a much broader network with marginal cost to increase your audience. It’s this ever-increasing democratized supply of news content that renders the threat in Australia a bit moot. We know that news doesn’t really make up too much of the content supply in the first place, and if it’s pulled, content like that of what you’re reading right now will replace it.

Advertising platforms

If media outlets want to continue to remain profitable when they don’t have free distribution from Facebook and Google, they will be forced to increase the top-of-funnel for their direct distribution mechanisms of apps, email, and push notifications to be effective. How will they increase traffic? They’ll buy ads.

The main thread in this entire post is free distribution.

If Facebook and Google simply block sharing news and shut down their aggregator products, media outlets lose free distribution and have to start paying for top-of-funnel traffic to get users to convert to paying subscribers. They need to build their subscriber base and now have a user supply problem. That means that instead of paying media outlets, Facebook and Google will increase ad revenue from increased media outlet ad spend.

Remember that currently, any company can opt out of Facebook or Google distribution using mechanisms provided by the companies themselves. They aren’t opting out for a reason: they need the eyeballs.

Wrapping up

When you mess with market equilibrium for a good cause or for lobbying, if not thought through correctly, you could be exacerbating a problem or creating one that didn’t exist in the first place. It needs to be well understood and thought through, in the same way that we see a cautious approach to antitrust litigation in the US.

In the case of the Australian regulation and ACCC news, I can’t help but wonder who the driving force is. Seems obvious, but if regulation gets put into place, it’s likely that the aggregators, Facebook and Google, will simply pull their news presence out of Australia altogether. That will result in the newly created user supply problem, leaving media outlets to fend for distribution through ads or other means, directly benefiting the same companies the ACCC is trying to regulate.

If the true goal is redistributing profits, there are ways to accomplish that without this regulation. If the additional goal is to bring power back to the media, unless you help media companies create a product to meet news demand in the same way the aggregators do. I am not bullish.