🏭 What's in a chip? Breaking down the Semiconductor Industry

Chip types, IDMs, Fabless, and Pure-play: why they matter and what's next.

Update: This post is getting some traction. If you haven’t already, feel free to subscribe!

Over the past year we have seen a number of technology company acquisitions, and some of the biggest have been in the semiconductor industry. Analog Devices is looking to scoop up Maxim Integrated Products for more than $20 billion, NVIDIA agreed to pay $40 billion for Arm Holdings, and now AMD is in advanced talks to buy Xilinx for $30 billion. These are large numbers that are sure to get any technologist or investor talking.

Understanding the `why` behind these deals and the companies themselves is difficult unless we understand the fundamentals of the chip industry. Those fundamentals include the types of chips, the shapes of companies in the semiconductor industry, industry trends driving the market, and how company margins fit into the life of a chip. Companies produce different types of semiconductors for different use cases, some simply design them, and some are just the physical manufacturer. Each variable plays into the strength of the company and their ability to adapt to the future of computing, and those variables are shifting.

So what’s next for the semiconductor industry?

What’s in a chip?

As we look at the semiconductor industry, it’s important to understand the types of chips built from these semiconductors and their functionality, so let’s start with the main, broad types of chips that semiconductor companies produce. While there are many different chips, the main types are:

- Microprocessors (e.g. CPUs)

- Memory (e.g. RAM)

- Graphic Processing Unit (GPUs)

- Standard or Commodity Integrated Circuits (e.g. SoCs)

- Analog

- Mixed Circuit

Microprocessors

Microprocessors typically are referred to as CPUs, or central processing units. Think Intel or AMD processors that power your computer, server, or mobile phone with N number of cores. They are the brains behind the computation happening when you run a complex program rather than one of repetition, making them ideal for the personal computing use case for programs and apps. These processors are typically built on a shared chip ISA (Instruction Set Architecture) like x86 or Arm.

Example companies include: Intel, AMD, Samsung

Memory (e.g. RAM)

Memory chips are those used to store data, like the short-lived memory on your devices called RAM or long-lived memory like flash storage. There are many other types of memory chips as well, but the general idea is that these chips are used for storing your data.

Example companies include: Micron, Samsung

Graphic Processing Unit (GPUs)

GPUs are the chips responsible for the graphics you see everytime you open up a computer or mobile device. They power the computation needed to populate each pixel on the screen. Nowadays, the GPUs are much more multi-purpose than just graphics, which is why we see them in the news a lot. They are being repurposed and augmented to work more efficiently for things like cryptocurrency mining and AI powering driverless cars.

Example companies include: NVIDIA, AMD, Intel

Standard or Commodity Integrated Circuits (ASICs and SoCs)

These chips are a broad range, but typically are used for single-purpose devices (ASIC) or SoCs (System on a Chip). For a single-purpose device, think of an electronic toy, and for a SoC, think about a chip that combines multiple other chips and circuits that, for example, uses a microcontroller to take care of processing, graphics, wifi, and a cellular antenna all-in-one for your mobile phone. If you are a tinkerer, the Raspberry PI also runs mostly on a SoC.

Example companies include: AMD, Xilinx, NVIDIA

Analog Chips

Analog chips are used a lot of times where there is a need to connect the physical world to the compute world, such as computer power supplies and sensors. The power supply takes electricity and converts it to compute power and the sensors take things like light or temperature and convert it to machine readable information.

Example companies include: Texas Instruments, Analog Devices, Infineon

Mixed Circuit

Augmenting analog and standard ICs, mixed circuits act as the bridge between the digital and the analog world, converting digital signals to analog signals and vice-versa. In the example above on the sensors, the conversion from analog machine information of light, sound, or temperature to a digital format to be picked up from your computer.

Example companies include: Texas Instruments, Analog Devices, Infineon

As you can see, there are differences in each of the semiconductor chip types with a large amount of overlap not only in the functionality or need to combine various chips to make a product, but also in the companies either offering or specializing in each. Sussing out this information is critical because the use cases of products in the technology industry and the broader market drive the use cases that semiconductors and their companies need to support.

Before we get into what drives the market, it’s also important to understand that the various companies mentioned above can each have a different shape.

IDMs, Fabless, and Pure Play

What’s the difference, for example, between AMD and Intel given that they both seem to overlap a lot on their product offerings? Well, it’s the same as the difference between Apple and Microsoft PC products: one is vertically integrated and one is horizontal, leveraging other players to take care of, say, manufacturing.

IDMs, or integrated device manufacturers, like Intel or Micron, not only design their chips, but also manufacture and sell their integrated circuits. While this does mean that there are efficiency gains through that vertical integration, it also means that they are on the hook for the up-front cost and maintenance of fabrication plans for each of their products. These fabrication or production facilities are extremely expensive on both those build and maintenance costs. That expense, coupled with the increased complexity of not only focusing on the design and sale of the product, but also the manufacturing, has led to horizontal alternatives.

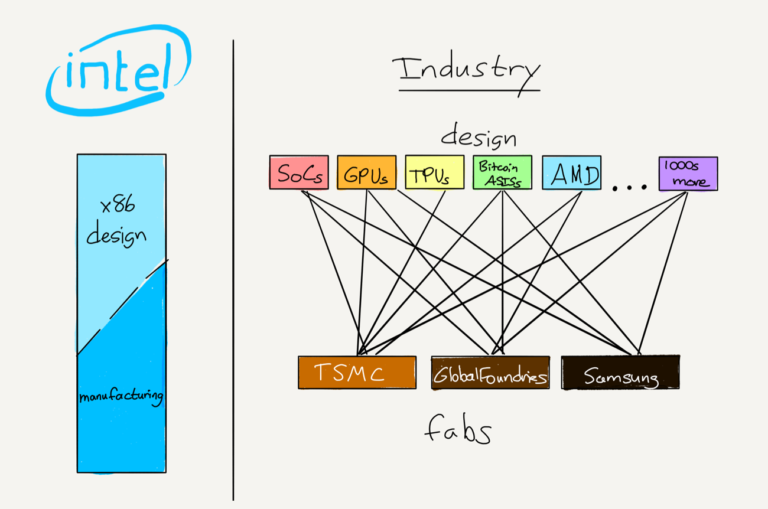

In splitting the IDMs into two separate stages, we have the design and sale versus the manufacturing of chips.

Companies that design their chips, but do not manufacture them, are called Fabless companies. Taking the AMD and Intel example, AMD is a fabless company that takes the horizontal model of designing, marketing, and selling its products while outsourcing manufacturing to companies, mainly GlobalFoundries. NVIDIA, the major player in GPUs, is also fabless, relying on fabs like TSMC (Taiwan Semiconductor Manufacturing), Samsung, and Micron to manufacture the various chip components to their graphics and AI product lines.

Companies like TSMC and GlobalFoundries, are Pure-play and only provide manufacturing contracts for silicon chips and chipsets designed by fabless companies. They leverage contracts between the two companies to maintain a horizontal relationship, allowing fabless companies to reduce the cost of building and maintaining production fabrication facilities while providing specialized expertise in scheduling, pricing, and manufacturing operations for efficient use of their maintained fabs. It seems like everyone wins, as long as the bargains are held up.

Here’s an awesome visual from Ben Thompson’s article, Intel and the Danger of Integration, laying out the three above paragraphs nicely:

The benefits and drawbacks of the vertical IDM approach vs the horizontal Fabless and Pure-play approach are readily apparent. If you have a vertical approach to your chip design and manufacturing, you need to have breadth and depth of design and manufacturing expertise, a solid operational model, and the cash to scale and maintain your fabrication facilities. The benefit is that product itself, as in many vertical markets, can have some efficiency gains because the design and manufacturing process can be aligned and specialized to the individual products. Though, this is becoming less and less true, as companies are making the shift to fabless because manufacturing is, well, hard.

The last thing here is that the dichotomy between the vertical and horizontal is a bit untrue, even if easy to reason about. There are many IDMs which are not just vertical, but that also will contract out their fabrication facilities to other fabless companies, like Samsung, who is working with NVIDIA to manufacture 7nm GPU technology. This mixing and matching of vertical and horizontal models for the semiconductor industry is another step into the shift between IDMs, Fabless, and Pure-plays.

The market

Now that we have an understanding of the different types of chips built from semiconductors, as well as how companies organize themselves in the industry, we can move to look into what these chips might be used for and what consumer behaviors are driving the trends.

The first is the need for cloud datacenter processing power. As computers, programs, apps, and applications require the need for more processing power, the microprocessors need to keep up. AWS, Azure, and Google Cloud Platform are all competing for your business and need to keep up with the Joneses as the need for compute power and speed pushes forward.

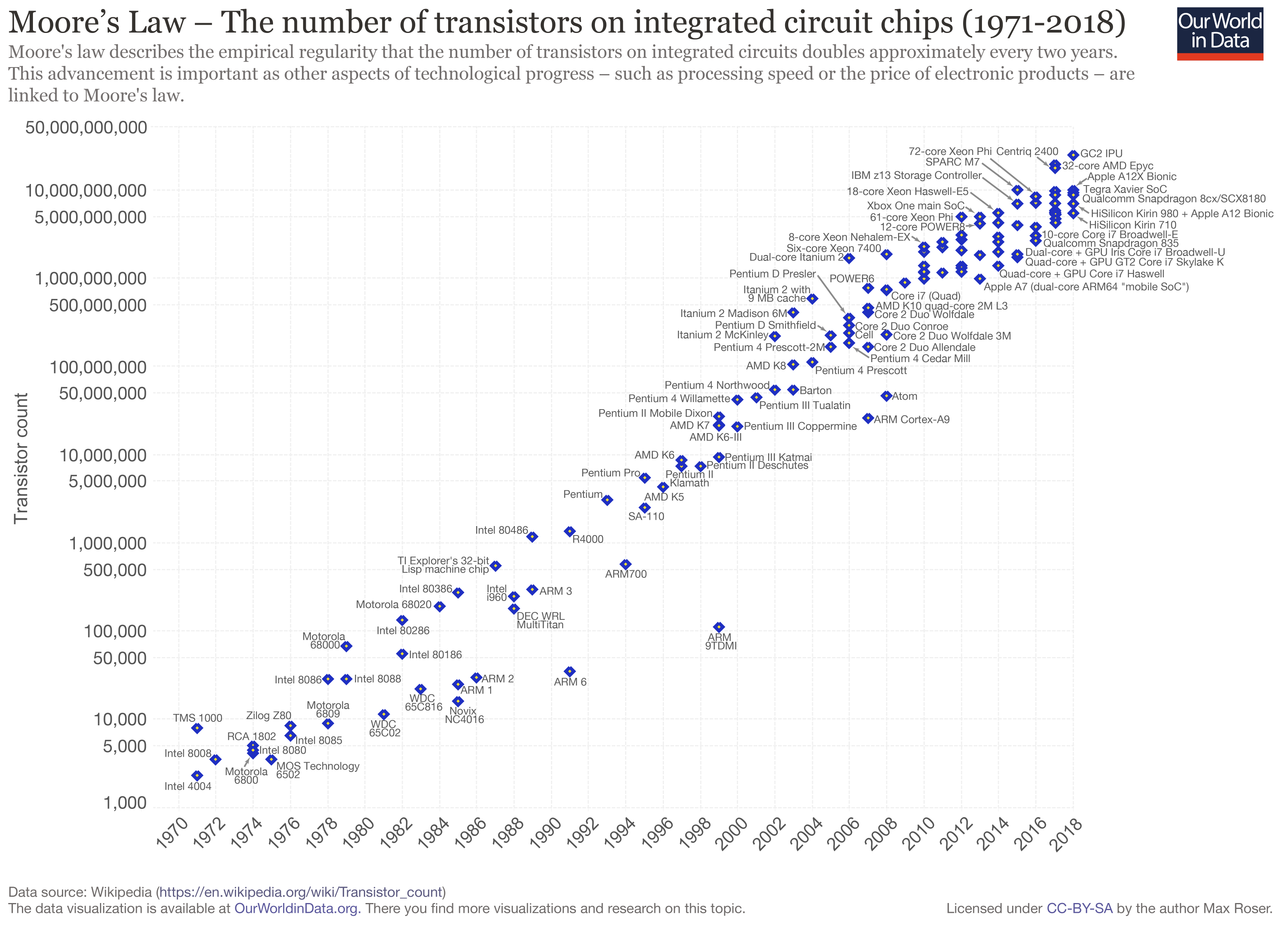

Moore’s Law is the observation that puts this best into practice: the number of transistors on a chip doubles about every two years.

If you look at the above graphic from Our World in Data, you can see that this is largely holding true as transistor growth matches 2x per year. There is some contention if this can continually hold true as we approach physical limits, but this year, we are already starting to see 5nm technology being manufactured from 7nm in 2018. Smaller nodes means more to pack on the chip, which means more processing power. More processing power for the cloud and your laptop at home.

The second is mobile. Think about how small your laptop and phone have gotten, nearly down to the physical limits of what is human usable. I am sure the human race will continue to surprise with tinier, thinner products, but right now there is a continued push on making the small devices even more powerful. That means more processing power on smaller and smaller chips by the way of adding transistors, just like we saw in Moore’s law above. But that’s not all. It’s not all about processing power, but also about energy efficiency. Ensuring that a chip running on mobile can extend the life of the battery by having more efficient computation is a major driver as opposed to say that of chips running on the server with a dedicated power supply. Arm, who designs chipset architectures and chip technology, is a major player in mobile, looking to push the limits of what’s possible in a tiny space with limited power.

The third use case is AI, self-driving cars, and cryptocurrency. What do all of these have in common? Well, like stated earlier, unlike microprocessors which are really great for complex computation, GPUs are optimized for programs that can be parallelized. This allows simple, repetitive computations to be executed quickly and has made GPUs extremely popular in the crypto space which relies on large amounts of repetition. In the same vein, AI (or ML) models are trained using large datasets run through an algorithm to find patterns in the training data. Running all of that data through the same algorithm can be parallelized using GPUs to increase the speed of the operation.

The above three use cases are driving the semiconductor industry. Companies focused in these areas right now are seeing solid returns on investment and growth in the markets. Companies that focus on technology that’s But it’s not all about growth.

Margins on margins

A wise person once told me that if you want to invest in building, invest first in the shovel. What they meant by this, was that the end-product is the most risky and volatile piece of the end-to-end manufacturing process. As you approach the end product, the more you fall to consumer demand and complex market dynamics. The closer you are to the manufacturing, the more multi-use the components are, say like a fabrication plant or a chipset. So too follow the differences in margins and risk.

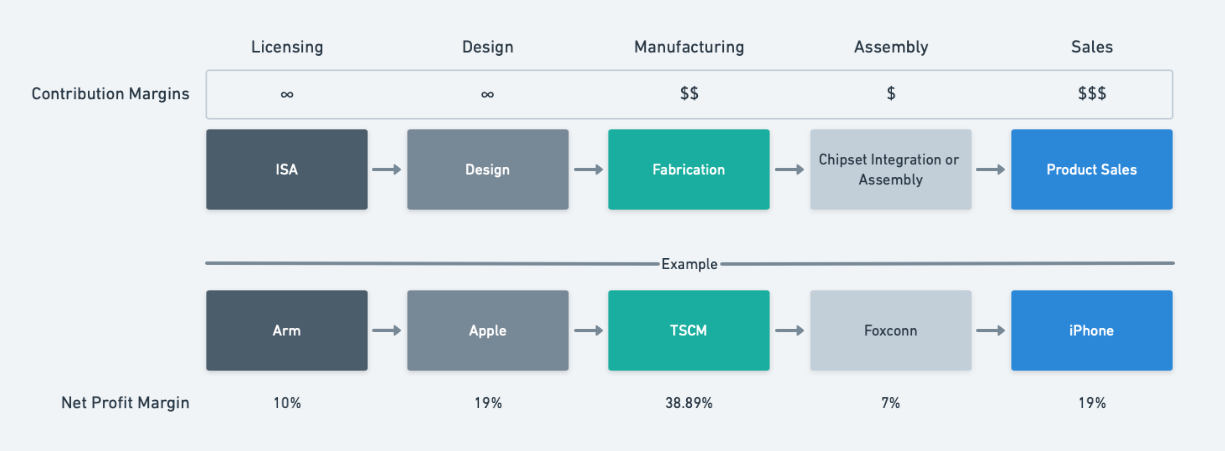

Why is this important? Well, if you look at the margins in the above diagram, you can see that the margins of different companies at different points in the lifecycle of technology hardware development differ widely. The two different types of margins above are a contribution margin, or a per-unit margin, and a net profit margin, typically used for overall company revenue minus cost of goods and labor. Calling these two margins out allows us to understand the general unit economics of each step in the process as well as the overall company profit as it relates.

In this example, we take the iPhone and look at these two margins, you can see that there is a difference in the unit economics and profit margin at each level. At the ISA (or Instruction Set Architecture) steps and at the design steps have an unlimited contribution margin because once the ISA and/or chip design is complete, the typical sale unit is a license on a per-unit and per-product line basis. This means that the upfront work has up-front investment, but the unit can continually be sold for 0 marginal cost. The same is true, as a corollary, to the services industry in technology such as Spotify or Facebook or Instagram.

Moving to the fabrication, assembly, and sales steps, we see the contribution margin starts to become concrete. The chip that’s created at the fabrication plant typically has a high unit cost and low unit margin based on the need for the fabrication plant cost. In the assembly or integration step, the margins are compressed as well, due to the economics of assembly plants focused on single items, like the iPhone. The sales step is where the contribution margins (per-unit margins) increase dramatically. The iPhone has a 60% contribution margin and even higher for some of the higher end models like the 11 Pro.

As you think about the various companies in the semiconductor industry, their shape as an IDM or Pure Play for example, and how they fit into the larger picture, these variables including profit margin and risk profile may sway decisions on which companies to invest in. A company that takes on a higher risk, say TSMC with the large up-front costs of fabrication plants or Foxconn with assembly plants for products like the iPhone, typically has lower contribution margins than the company selling the finished product.

Putting it all together

That was a lot, but if you’ve made it this far, we now have some fundamentals to discuss what’s next.

Looking at the AMD/Xilinx, NVIDIA/Arm, and Analog/Maxim acquisition deals, we can see that there’s a consolidation of the semiconductor industry in the same way we see in the social media space, for instance. The difference here, though, is that semiconductor companies are not easy to spin up and sell off quickly. Specifically IDMs or Pure-plays.

What this means is that we are likely to see, and are already seeing, strong Pure-play companies like TSMC and GlobalFoundries take over the industrial manufacturing and fabrication of chips, becoming more efficient and using economies of scale to improve margins over time. We already see TSMC with a near 40% profit margin that is increasing YoY, and as these companies get better and have even more scale, their expertise in the manufacturing process is going to get hard to beat. Similar to cloud computing, why would a new internet company try and build up their own datacenter to scale their business? They wouldn’t unless they were already at the scale they could justify that up-front investment, and even then, is it worth it?

This makes it easier for fabless companies, and there are many, to do what they do best: market and sell products that leverage the chips and chipsets they design, but do not build. The fabless companies, like AMD and NVIDIA, can focus on the end-consumer, industry trends, and how to get useful technology into customer’s hands. See NVIDIA’s latest product lines for how true that is. Instead of the Pure-play foundry companies needing to understand the end consumer, they only need to understand the end customer: the fabless semiconductor company. Again, here is the corollary with cloud computing. Consumer app companies, for example, aren’t going to start by building their datacenter, they are going to try and get product-market fit so that they can scale their business. The same is true for fabless companies.

So where does this leave IDMs?

IDMs are an interesting bunch, because they can go either way. My hunch is that, as time goes on, we will see these IDMs split into either a fabless or Pure-play company, either completely, or having parts of it’s business split into two separate units: one for design and one for manufacturing (Amazon/AWS or IBM, anyone?). No matter which way these splits happen, given the trends of the industry, they will need to figure out how to specialize, either entirely or as two companies running under one name. In fact, if you didn’t see the hidden Intel link above, they are already having trouble with their own internal manufacturing processes and are looking to augment their production of 7nm chips with a Pure-play company like TSMC. Sometimes you need to realize you can’t do it all.

Overall, given the physical nature of building chips and products in the semiconductor industry, the companies don’t have the effectively unlimited scale of software companies. This means that Pure-play companies are going to be fewer and further in between and become more and more valuable as chip manufacturing platforms, or Chips as a Service (CaaS) while fabless companies continue to push the limits of design to keep up with the changing market needs. IDMs will continue to try and do both, and not all of them will succeed, likely specializing in one area. For those that do, it would be better for them to split these into two separate units, and leverage their foundries efficiently to aid chip designers who don’t threaten their business.

One thing is for certain in all of this, it’s going to be fun to watch it all play out.