Techonomics Newsletter #4: CFCs, The Great Acceleration, and Truth Seeking

Hey all,

Welcome to the Newsletter #4 from Techonomics.

This week we take a look at last mile logistics news as well as some really interesting takes on COVID-19 impacts on the digital economy acceleration, an opinion on US and China data privacy, and what the recent executive order means for democracy.

As always, feel free to email me directly at dejno@techonomics.news with any feedback. If you want to subscribe, click below.

Enjoy!

— Dejno

One longer take

CFCs and the last mile: Two weeks ago we looked at Dumpling’s new model for having personal shoppers own their own delivery business, and I made the point that regardless of that approach and the personal shopper model, vertical models relying on CFCs (Central Fulfillment Centers) will win for last mile logistics as delivery times compress.

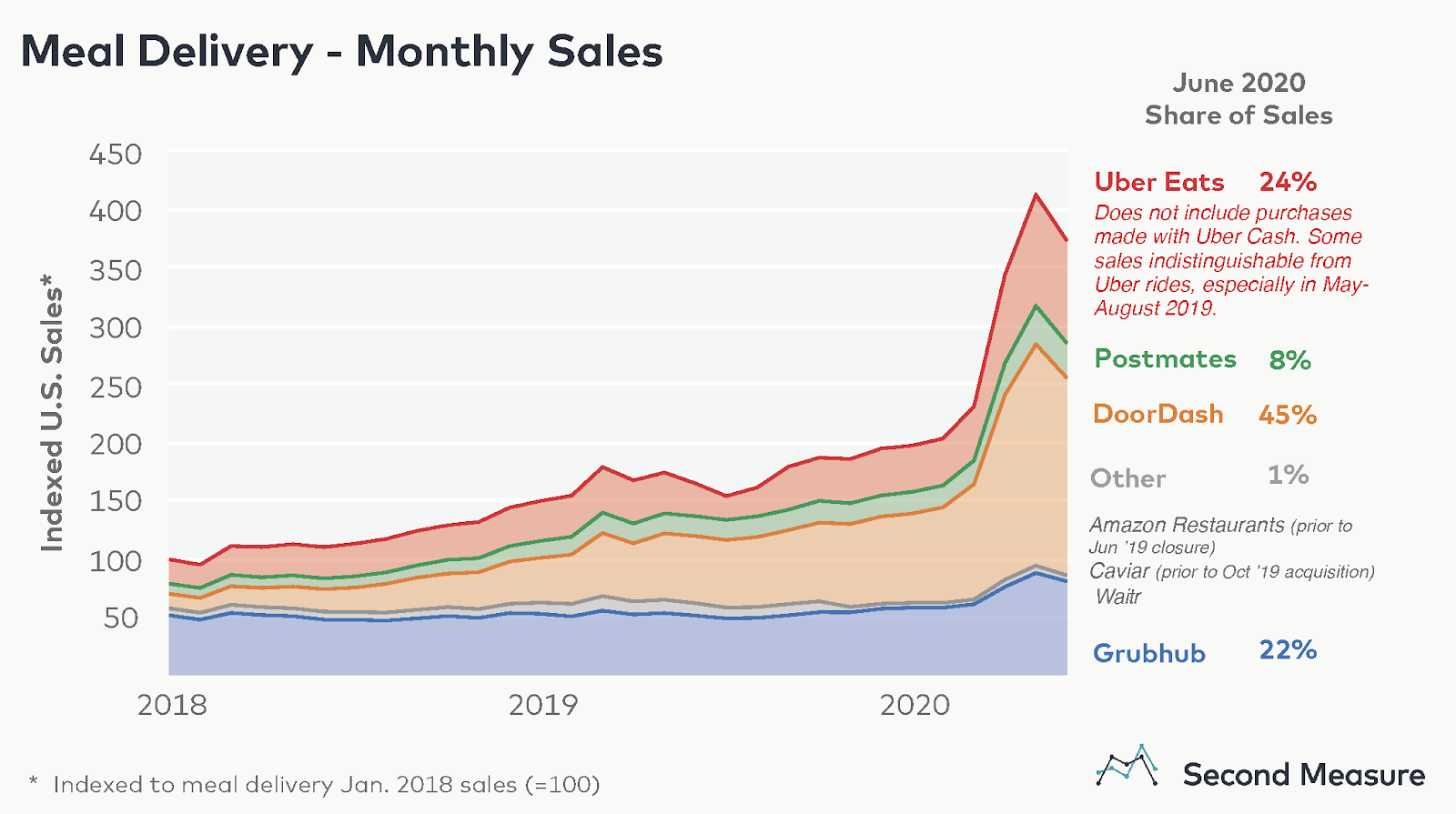

Last mile logistics are important for all e-commerce, and has been even more recently, specifically for food delivery due to COVID-19. Then last week, The Information took a look at a company called goPuff ($) and their quick growth in the last mile for convenience store item delivery. Luckily, I also waited until this week to publish this article because it was also announced that DoorDash is also getting into the game with DashMart. There’s a deeper point when you look at the landscape.

goPuff and DashMart are clear examples of a vertical model propped up by CFCs. Each company will own their last mile logistics thanks to the leasing of space fashioned into temporary warehouses within close proximity of their users. For goPuff, we see a 15 minute driving radius to its customers whom they charge $1.95 per delivery of their favorite junk food. Dashmart pricing details aren’t clear quite yet, but are likely competitive.

Amazon, Walmart, and others have been trying to get their last mile logistics setup running smoothly for years and are investing heavily from a few last mile locations to more than 240, not to mention the Whole Foods acquisition, to augment their already wide range of regional Amazon Fulfillment Centers.

Each of the large retailers worked backwards from the model we are seeing with goPuff and DashMart: they allowed for increased consumer choice of many products and relied heavily on global logistics to enable their sales, as well as those of their third-party sellers. This is why you see 3-5 day delivery turn to 2-day Prime delivery turn to same-day delivery turn to 2-hour Prime Now delivery, instead of the 30 minute delivery window offered outright by goPuff.

Given this, the value here in goPuff and DashMart isn’t as much the brand or junk food delivery so much as it’s their setup of last mile logistics hubs while controlling the delivery driver operations, competing with the likes of Amazon in niche convenience store item delivery.

They are competing with the big players by cutting out the middleman while keeping a smaller number of goods in stock. That limits consumer choice, but that’s a trade-off they’re making for convenience. It's convenience customers want, and based on market opportunity for last mile logistics as upwards of ~$50 billion, I could see goPuff as a major acquisition target. My money is on Uber who announced this week that Uber Eats revenue outweighed that of their driver division.

Again, it’s this vertical model and the close proximity to customers that’s going to continue to win as long as the choices hit their needs. These companies are solving a hard problem that’s become more important during the COVID-19 pandemic. As these companies continue to compete for delivery convenience prowess, vertically integrated CFCs will become the norm… alongside the robots ($).

Interesting reads

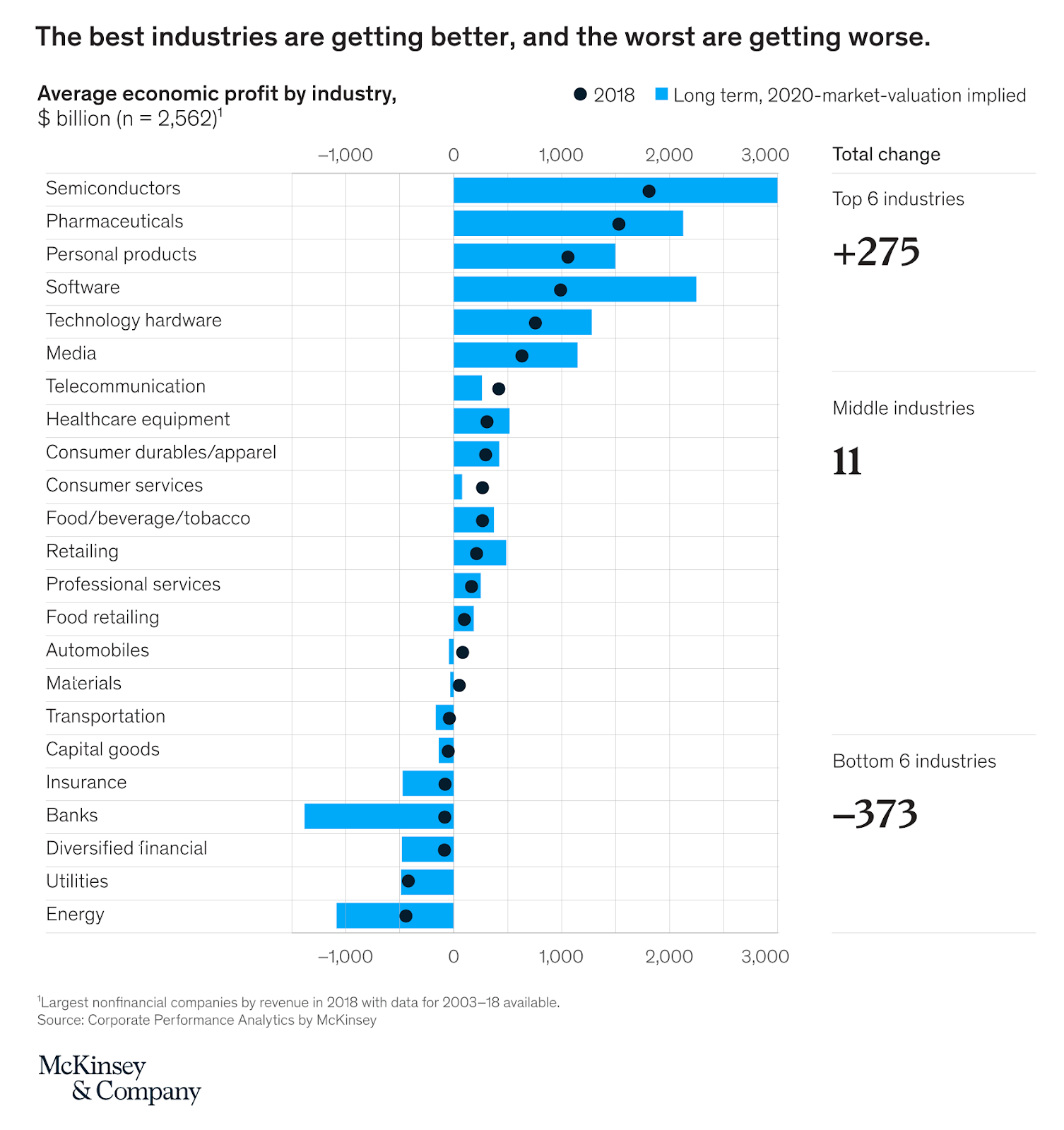

The great acceleration

Investors and VCs talk about COVID digital trends that prop up the internet economy while enabling social distancing. Industries propped up by the digital economy like semiconductors, on-demand grocery, and ecommerce are all extremely healthy in a time where other areas of the economy are struggling. We see this clearly in the stock market.

The attribution of accelerated growth to already growing trends had me questioning causation vs. correlation: were all of these trends happening prior to COVID-19? The answer seems a resounding yes, and it’s time for companies to start evolving for the long-term. (link)

Seeking truth: We’ve seen policing of misinformation on social media platforms recently, as companies feel a moral and ethical obligation to inform users about potentially harmful misinformation, such as the claim from Donald Trump that children are almost immune from COVID-19. Given this policing, we’ve seen an onslaught from The White House on Section 230, which provides legal immunity to platforms like ISPs, blogging sites, and social media networks from litigation around content the users post on their platforms.

Why is all of this important?

Section 230 is a major reason why American internet companies have grown and provided economic growth for the US. On the other hand, these platforms have lots of power through censorship, even when incentivised to stay out of it. Regardless, I am of the strict opinion that weaponizing platforms to spread misinformation is wrong, full stop.

It wasn’t that long ago when Randomized Controlled Trials were first published in the 1950’s, helping us prove fact from fiction. Until these platforms police truth or bias action against society, allowing them to enact their right to free speech by labeling (not removing) posts as potential misinformation is, to me, a step in the right direction towards seeking truth. Let’s not reverse progress. (link)

A little bit of this, and a little bit of that: In Newsletter #1 and Newsletter #2 we discussed Robinhood’s outsized impact on market economics and the sports betting migration to the stock market. In addition to those points, Robinhood recently introduced Fractional Shares which give Robinhood retail investors the ability to buy parts of a whole share, enabling purchases of high flying stock like Amazon and Tesla. Fidelity, Schwab, and other platforms also recently announced Fractional trading and customers are absolutely using it.

Some say fractional shares democratize the markets due to a lack of stock splitting in recent years, while others say it’s dangerous and puts retail investors at risk. Like most debates, it depends.

While other platforms have enabled fractional shares, Robinhood users’ average age of 32 and typical trading behavior puts the onus on Robinhood to educate their users. As more access to the markets continues, the market needs to evolve a pricing strategy of momentum stocks to deal with speculation. So continues Robinhood’s outsized impact on the markets. (link $)

Preventing a US Luckin’: The US this week is seeking to bring the same regulatory scrutiny to Chinese companies listed on the US stock exchanges. So far, these companies has been able to skirt US regulators while leveraging the US public markets. While I think there’s more to this politically in the big scheme of US and China relations, I do believe that home countries have a right to regulatory scrutiny of company financial data on their exchanges. It is important to level the playing field on any international exchange in the hope of protecting investors. (link $)

Does the US have a “clean” internet? This week the US Secretary of State, Mike Pompeo, released plans for the Clean Network, seeking to protect American’s from China’s misuse of their data. Donald Trump also signed an executive order against Chinese apps operating in the US ($). While these efforts do have a very important message that we need to protect our data, is this something the US has always done for its own citizens? Here’s an interesting take that I don’t agree with fully, but that does provide some solid arguments. (link)

Technology, delivery companies, and vaccines: This was a really interesting read about delivery logistics. We talked about last mile logistics for groceries above, but what about sending billions of vaccines around the world? (link $)

TikTok, executive orders, and democracy: As stated above, Donald Trump signed an executive order against Chinese apps operating in the US ($) this week, taking effect in 45 days and impacting a broad swath of US and China technology businesses with nonspecific terms. It’s clear that this continued standoff between the US and China is going to impact businesses on both sides as supply chains, partnerships, and global operations are halted.

If there’s one interview to read on the topic, it’s that of Larry Summers, the previous U.S. secretary of the treasury under President Bill Clinton and former director of the National Economic Council under President Barack Obama. Really great insider view of the meaning of recent actions on American democracy.

That being said, I am still trying to get a handle on all of the details. There’s a lot to unpack to cultivate an unbiased opinion, and I don’t think I am there yet. (link $)

Bites

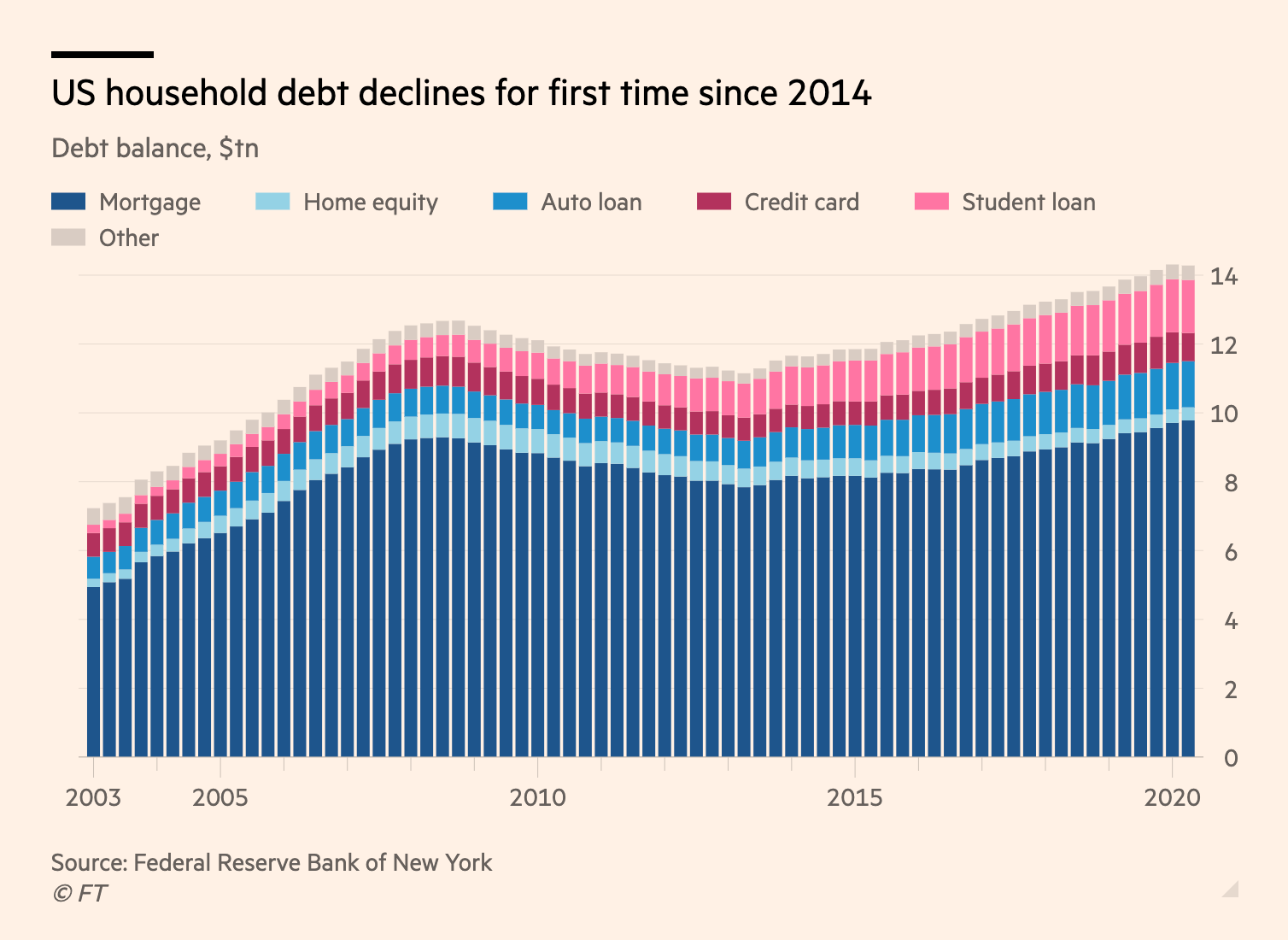

Chart of the week: some positivity for the COVID economy. (link)

Coffee supply chain: Really neat infographic. (link)

Shopping PSA: Are there really 7 other people viewing that item? (link)

Protecting the 4Gs: New ways to prevent cell tower spoofing. (link)

To infinity and back again: Some ‘uplifting’ news (link)

Police scanning & machine learning: A deeper, engineering view of how Citizen works behind the scenes. Humans + robots FTW. (link)

Disclaimer (full)

Views expressed in “content” (including posts, podcasts, videos) linked to or created in this newsletter, website, posts, or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of any person, company, or entity I am affiliated with or each entities’ respective affiliates. The content is not directed to any investors or potential investors, and does not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.