Techonomics Newsletter #3: Big Tech and Antitrust

Free-market capitalism, antitrust, and what Congress can do about it

Welcome to the third Techonomics newsletter!

On top of our normal scheduled programming we have a special longer take that analyzes the antitrust allegations against big tech spurred by the Congressional hearing that took place on Wednesday.

I hope you enjoy it!

— Dejno

One longer take

The capitalism paradox

Technology companies have been rising in size and power since the commercialization of the internet in the 1980’s, but didn’t see the top of the market cap list until Microsoft in 1997. Today, we continue to see technology companies like Apple, Microsoft, Google, Amazon, and Facebook dominate the internet through their powerful products and platforms that make the internet easier to use than ever.

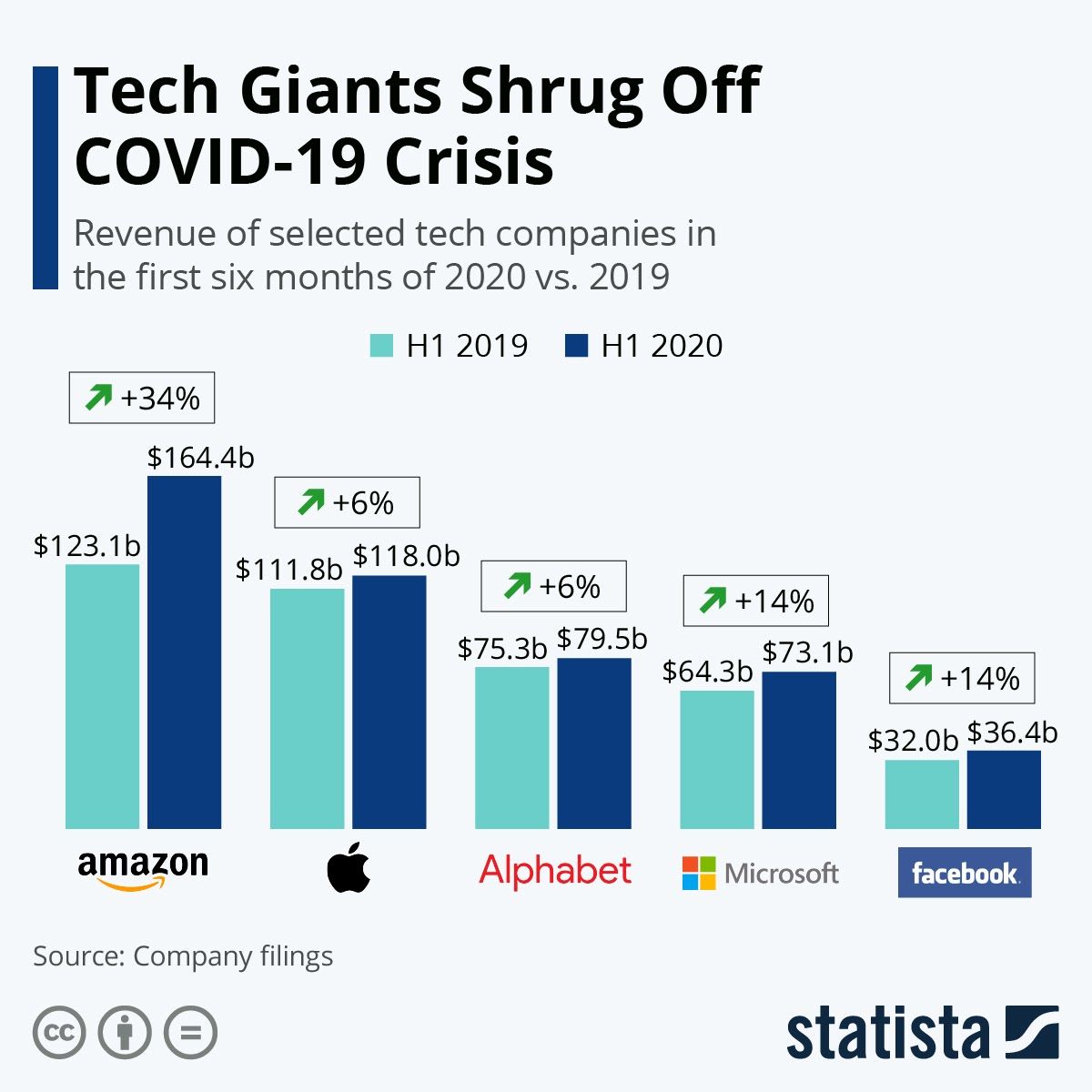

Rapid innovation has propelled these companies to success, reflected in their combined market cap of roughly $6.5 trillion. We even see these companies defy the gravity of the COVID pandemic which has left most other industries tattered and torn.

As companies get to the sheer size, scale, and power that these companies have, they come under scrutiny. The narrative shifts from how products and platforms can be used to better the lives of consumers and businesses to a narrative of unchecked power used to control markets through dominance and anticompetitive behavior.

Interestingly, America was built on laissez-faire capitalism, yet, once a company gets to an undetermined size or level of power, it is scrutinized through the enforcement of antitrust law which seeks to prevent any suppression of free trade through monopolistic behavior such as collusion, unfair anticompetitive business practices, and market dominance using mergers and acquisitions. It’s this paradox that makes last week’s news so important.

This week’s Congressional hearing, Online Platforms and Market Power, Part 6: Examining the Dominance of Amazon, Apple, Facebook, and Google, was the investigation of market power by 4 large tech companies (where’s Microsoft?) using nearly 500 pages of internal company documents.

The 5+ hour hearing itself was a doozy, and what I consider a verbal firing squad of questions posed by impatient members of Congress. There were even outbursts from sitting members of the committee.

There was an introduction from the chair of the committee and a few Congressmen before each of the CEOs used their 5 minutes to talk through a summary of their written testimonies (Alphabet, Amazon, Apple, and Facebook).

After the testimonies, the CEOs were questioned about their market power, anti-competitive behavior, and acquired dominance as internet intermediaries. They were also questioned about orthogonal and politically slanted themes of power in elections, censorship, US allegiance, and political bias.

Throughout the hearing, each of the CEOs interwove the theme of American capitalism into both their testimonies and their responses to questions from the subcommittee, sometimes directly through their rags to riches stories and sometimes indirectly through the companies’ innovation that props up capitalism for small and medium sized businesses on their platforms.

Bolstering the economy

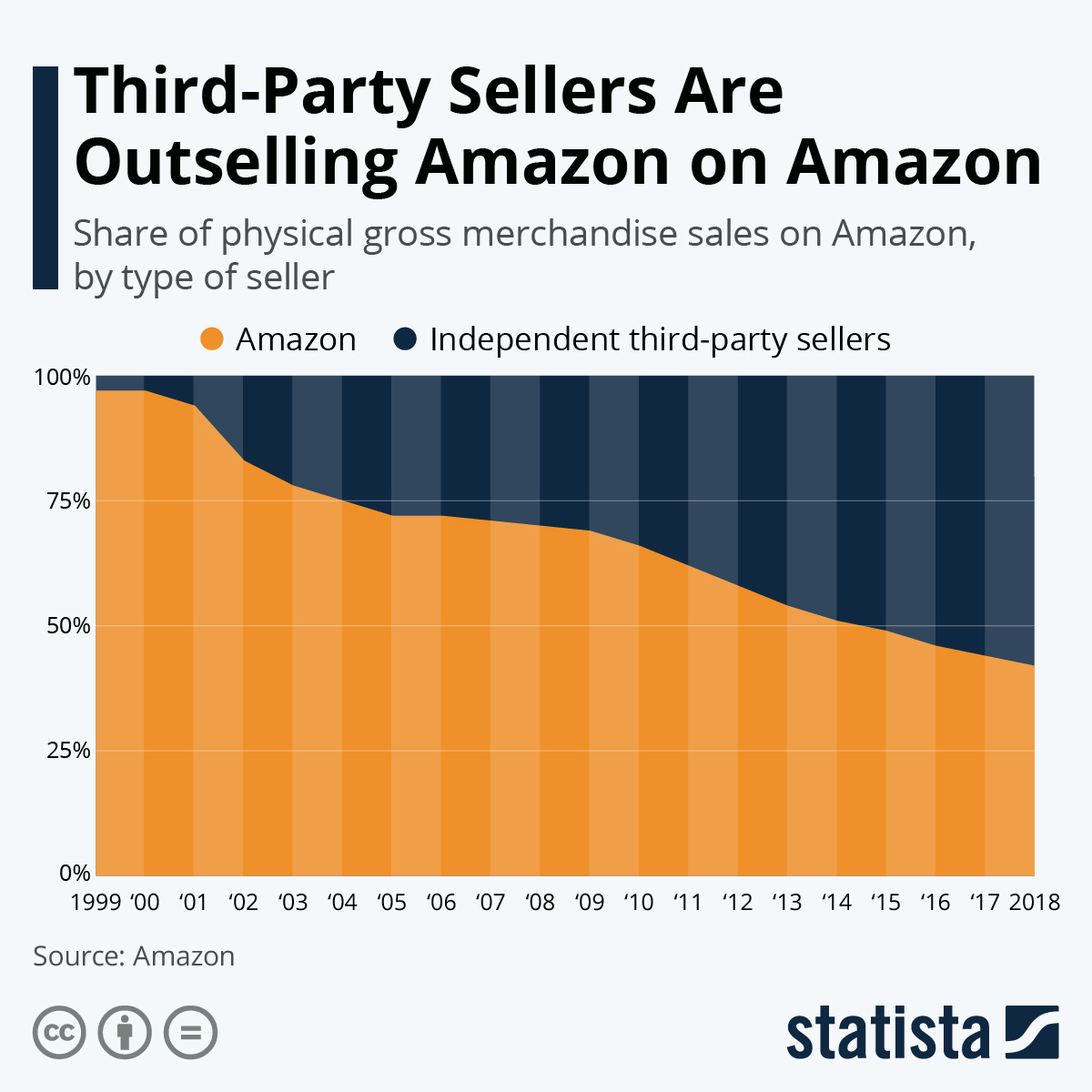

This theme of propping up the American ideology of capitalism is not false fodder. If we look at the number of third party sellers leveraging the Amazon platform, we see that independent sellers are outselling Amazon… on their own platform.

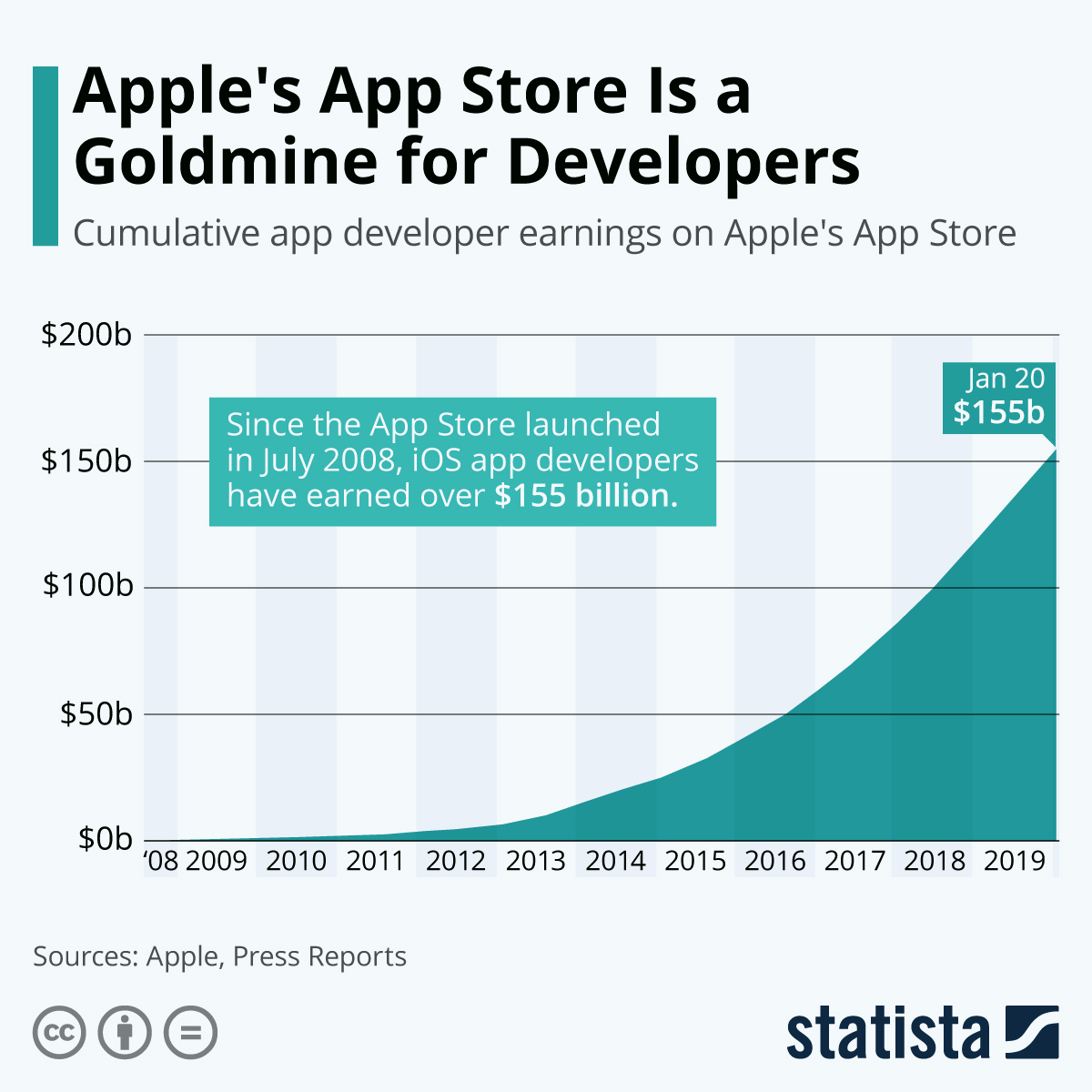

We also see that Apple actually props up the developer economy and provided app developers with a cumulative $155 billion dollars from 2008 to 2019.

While Apple takes a cut of the profits, without the App Store, one could argue that we wouldn’t have successful enterprises, small dev shops, and indie developers.

Alphabet and Facebook have a bit of a different take given that both companies run on ads that help businesses drive traffic. It’s much harder to point to ad spend’s benefit to the economy.

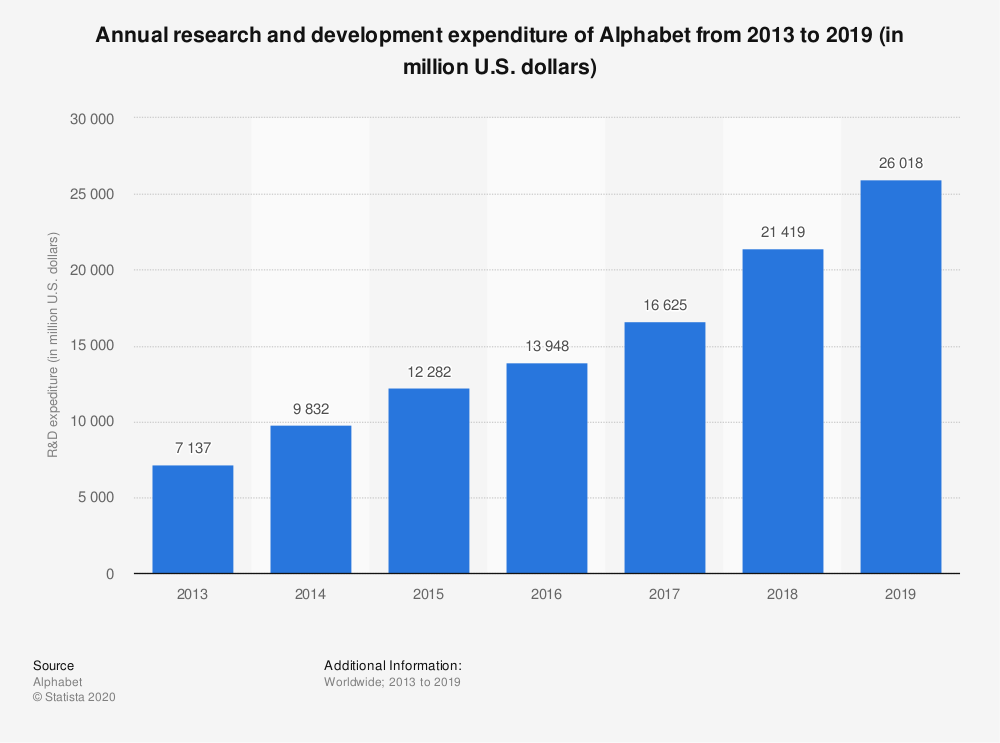

Alphabet had additional ammo using their free products and platforms like Android to power an open-source way for competing companies like Samsung to make money without licensing, as well as loads of R&D spend to show their worth.

Given that data, the antitrust argument looks relatively weak, but one might then say that, even so, these companies have market dominance and a lack of competition. During the hearing, each company pointed out ever-increasing competition in their various market segments, and they are not all wrong.

Competition

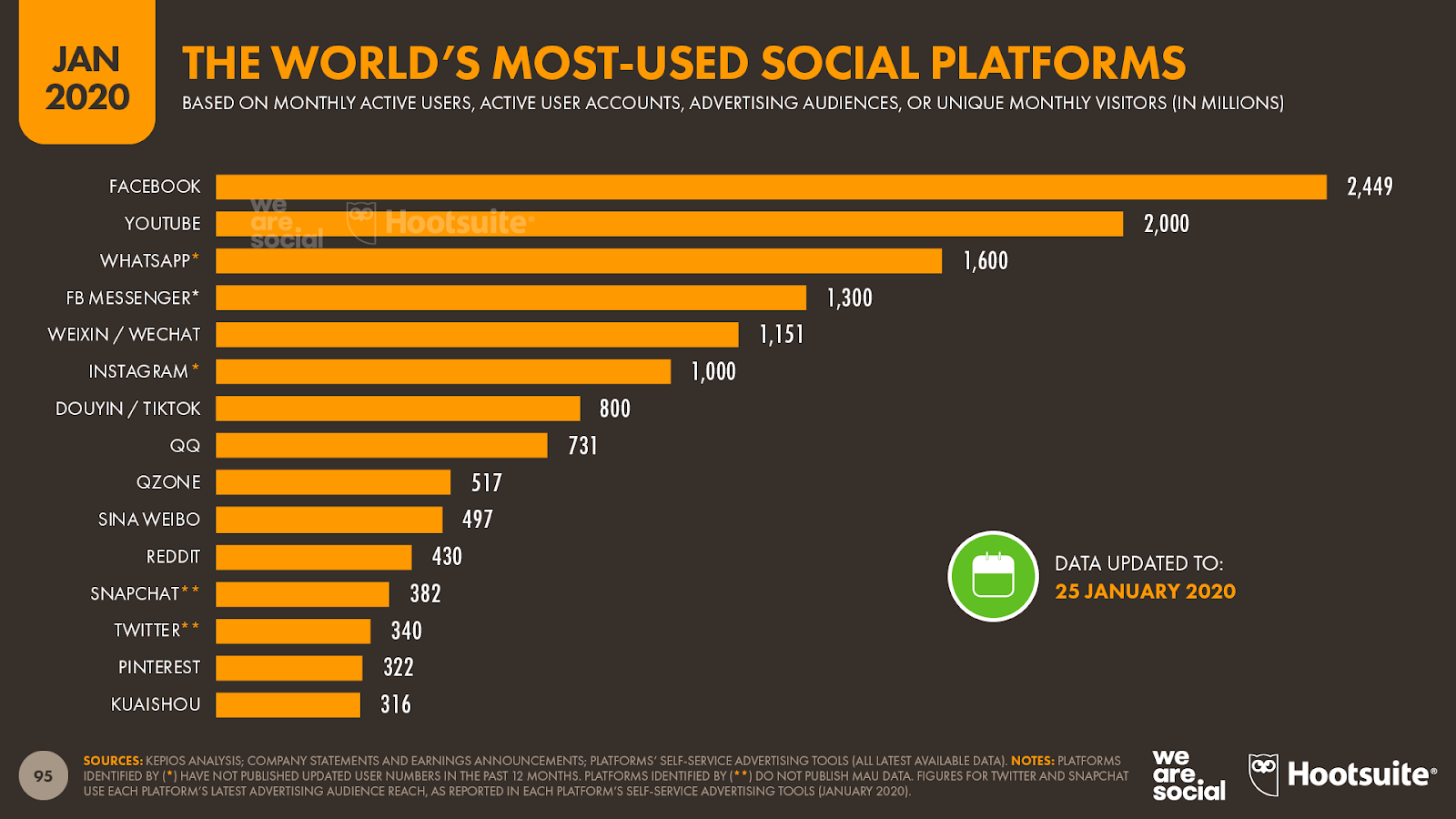

Let’s start with Facebook. They have a lot of competition: TikTok, Snap, Reddit, Twitter, and YouTube are just a few examples of larger products that are competing in the social space. Even if Facebook has a dominating market share with its suite of social networks like Instagram and WhatsApp in addition to its flagship offering, it’s important to understand that consumers and businesses have a choice to use whatever social media platform they like. Doesn’t quite hit on a monopoly.

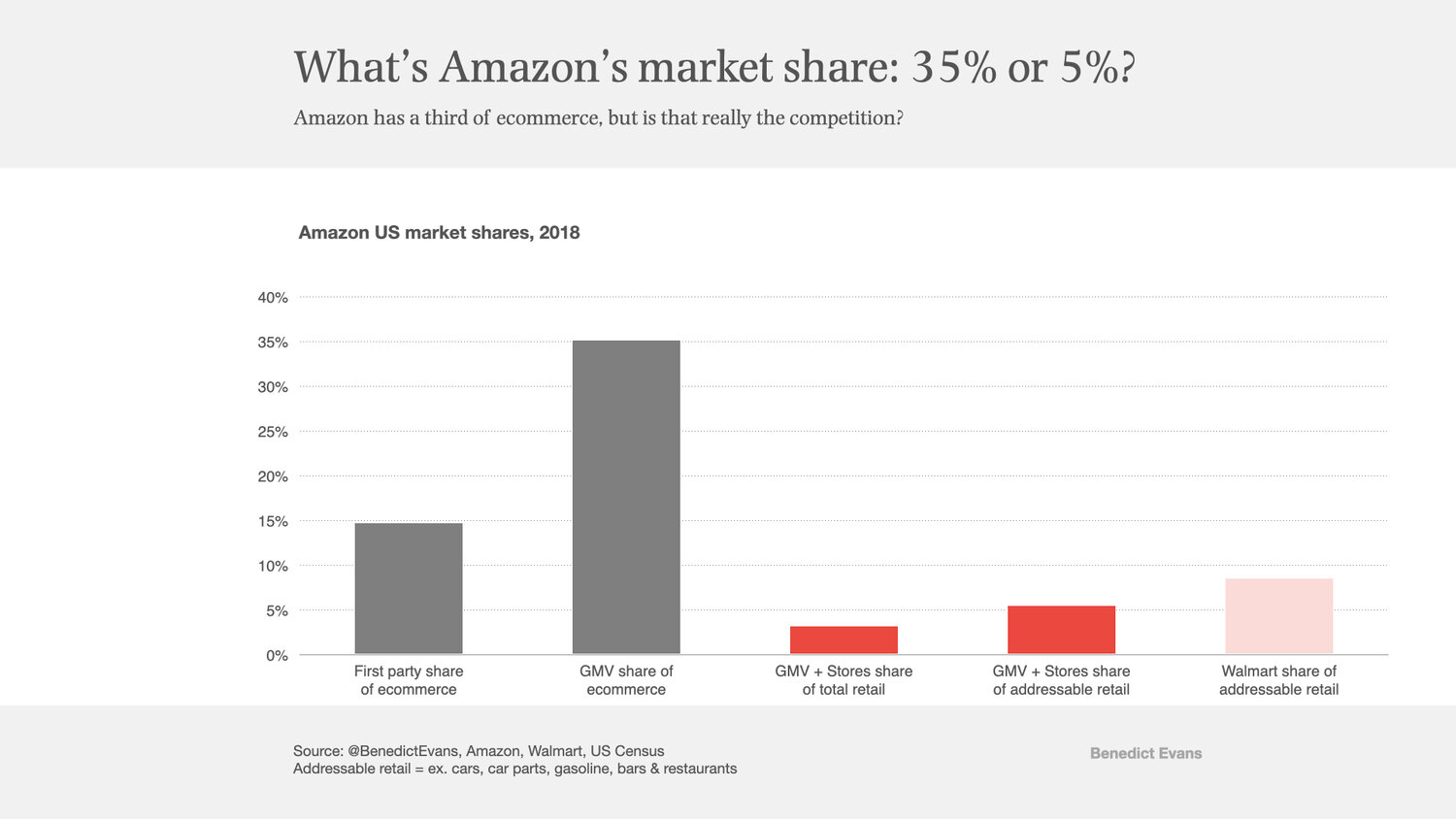

Next, Amazon’s retail competition really depends on how you cut the industry. If you look at e-commerce, they have a ~38% market share in the US. Looking at overall retail though, Amazon has anywhere from 5 to 6% and is competing with the likes of Walmart and Target. That doesn’t feel like a monopoly to me.

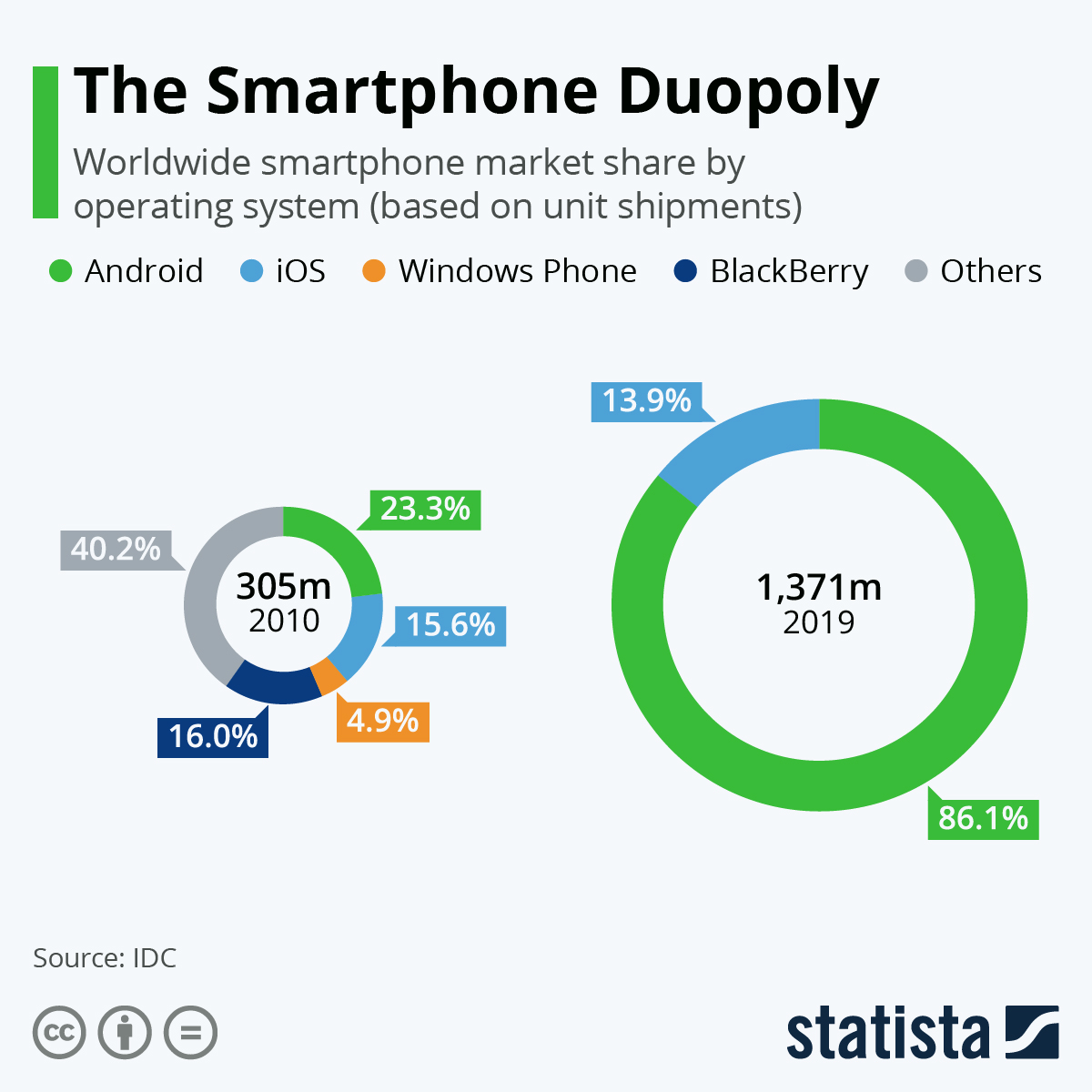

For Apple, the competition is sitting in the room: Alphabet. If we look at the market share for iOS vs. Android, it’s pretty apparent that iOS doesn’t dominate the market in volume even if they do dominate in consumer spend.

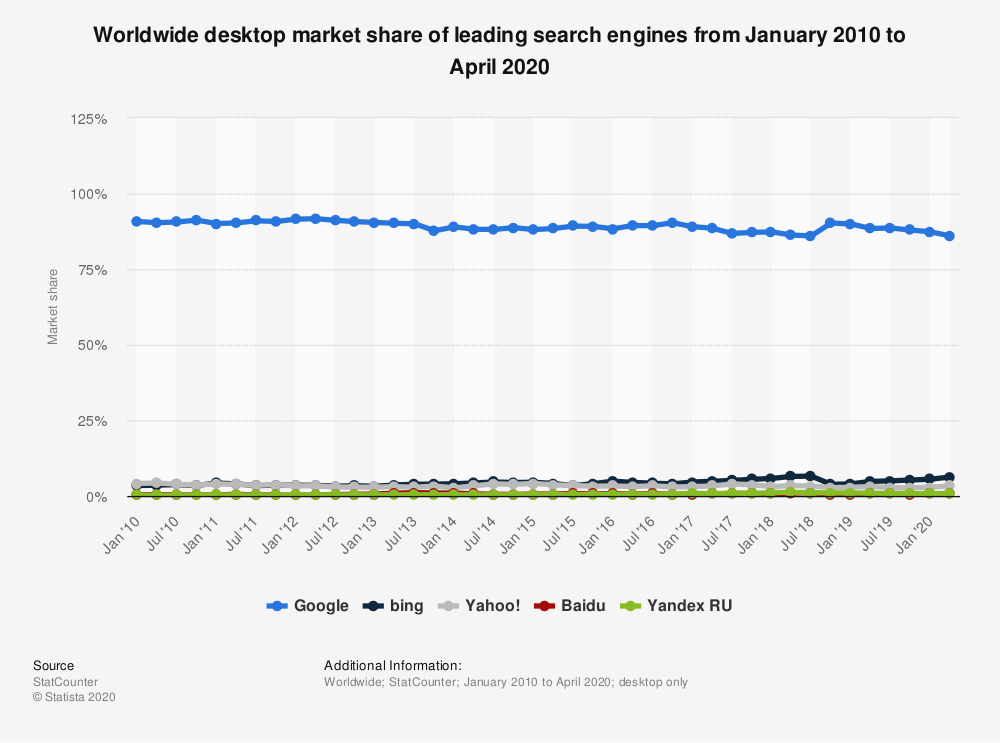

Alphabet’s competition isn't as easily explained and is way more likely a monopoly. Google has about ~90% of worldwide search traffic. It’s tough to forgive the 70% of overall revenue the company generates from ads when it controls a gateway to the internet, especially when more traffic through Google ends up… on Google. There isn’t much choice here.

Acting in the spirit of the law

Outside of the data to prop up these companies as innovators and examples of free-market capitalism, there is also the spirit of antitrust law that can’t be overlooked: the companies must be acting in the best interest of their consumers. This is where things get tricky.

Let’s take Google and Facebook as examples. Google provides free services like Gmail, YouTube, G Suite, and of course, Google Search to its consumers for free in exchange for ads and data collection. Facebook offers nearly all of its services to its consumers for free as well (Facebook, Instagram, and WhatsApp). Both companies continue to improve their free offerings. What’s not to love?

Outside of the data privacy concerns, there’s a flip-side to this. Facebook and Google both charge businesses to advertise on their platforms, monetizing free eyeballs from their free consumer services. This is the second consumer that these companies need to balance. What might be good for the end-user, say a consumer searching on Google, might not be the best for the companies that use Google to enable their e-commerce retail profits or ad traffic.

Which leads me to the real crux of the issue presented by Congress: these companies don’t always make the life of the second consumer, the developer, startup, or small business, better.

Tsk-tsk

Thus, Congress is getting fed up is the continued publicly and internally documented violations of that issue embodied in the second antitrust law, the Federal Trade Commission Act.

The goal of the FTC Act is to prevent shady business practices that reduce competition. This includes protection for the e-commerce site relying on Google SEO traffic, the developer relying on the App Store, the small business selling third-party on Amazon, and the startup looking to disrupt social media.

All of the companies at the hearing, in one way or another, are guilty of unlawful and anti-competitive practices that fall under the FTC act.

Alphabet:

Amazon

Apple

Facebook

Copying the features of Snap and, even with the probe going on, TikTok

Market complexity breeds enforcement complexity

What is hard about the above anticompetitive behavior is conveying a case for antitrust for each company (outside of Alphabet), enforcing the outcome, and keeping capitalism incentives alive.

The internet has exploded complexity of markets, bringing them from offline and tangible assets to online and often intangible assets like attention as a commodity, cloud infrastructure, and intermediary profits. It has also greatly increased the speed of innovation and change in the free-market, making it easier to adapt and attempt to dominate or purchase would-be competition.

In order for Congress to continue to protect both the individual and business consumer, there needs to be a new set of better defined and updated legalese that better represents new tech, the free-market internet, and data as a commodity.

New rules won’t do it all though. There needs to be enforcement of these laws that’s much more informed and educated on technology and big tech in order for these new laws to be effective. Education is ever-so-important as to not overcorrect.

Breaking up these companies will be harder to manage now ($) and preventing all M&A will be disastrous for startup founders and efficient business consolidation.

What’s next for big tech?

While there are examples of the way that these companies help consumers, developers, businesses, and society overall, there are very clear and well-documented examples of where they stifle competition.

These breaches of the FTC act concerning the business side consumer are not great for our society as a whole and make the capitalism and antitrust paradox look a little less stark.

Does that need to be addressed? Yes. Are they each a monopoly? No.

If Congress can increase its education of technology and the new free-market internet, write new laws that represent the violations by each company, and enforce those laws while not overcorrecting, the fear of these large conglomerates should dissipate and we can live in the joy of free-market capitalism in tech. Meanwhile, c’mon CEOs, can you play fair?

Interesting reads

A form of Tech lobbying: when you have the cash reserves, give people the day off to vote. (link $)

Continued investment in India’s de-investing in Chinese tech: India is still ensuring apps from China don’t infiltrate it’s market. (link)

Remote work isn’t what it’s all cracked up to be? It depends on who you ask. Here are a few takes from the WSJ ($), Visual Capitalist, and Zillow.

The theaters need some help: AMC announced it would reduce the window for a movie to go from the theatre to streaming in exchange for some streaming revenue. Are they reinventing the model as a hybrid with streaming? (link $)

TSMC’s rise to the top of the semiconductor ring: With Intel having loads of trouble, TSMC is showing its manufacturing prowess. (link $)

Video streaming wars: We talked last week about music streaming and Spotify dominance. This week, I came across an amazing overview of the video streaming wars. (link)

Bites

Cool visualization and forecast for the wearables market and remote work (link)

Check your cloud bill (link $)

Follow-ups

Follow-up on SPACs: a friend asked me, how do they raise money in the public markets? From Robinhood:

Disclaimer (full)

Views expressed in “content” (including posts, podcasts, videos) linked to or created in this newsletter, website, posts, or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of any person, company, or entity I am affiliated with or each entities’ respective affiliates. The content is not directed to any investors or potential investors, and does not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.