What happens when hardware and cloud companies design their own chips.

If you are a paying subscriber, you are getting this post nearly a week early. Thank you for all of the support along the way, and please share with your network!

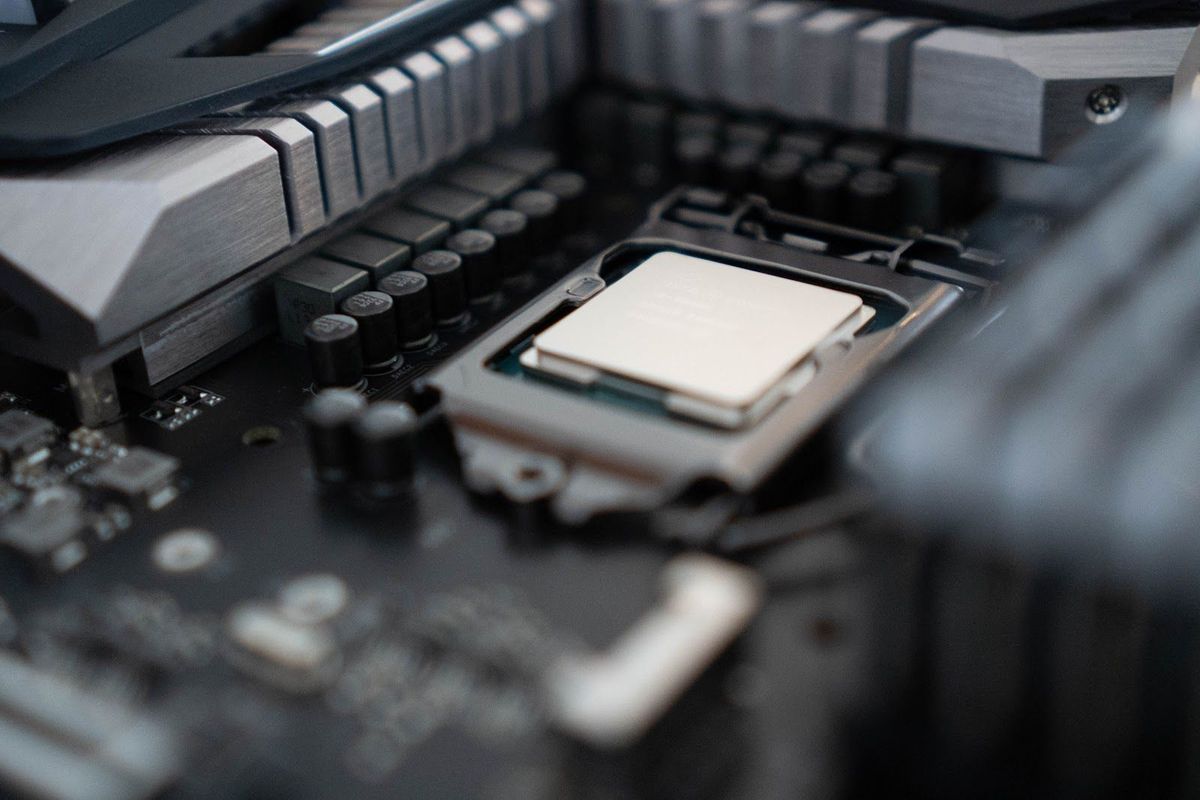

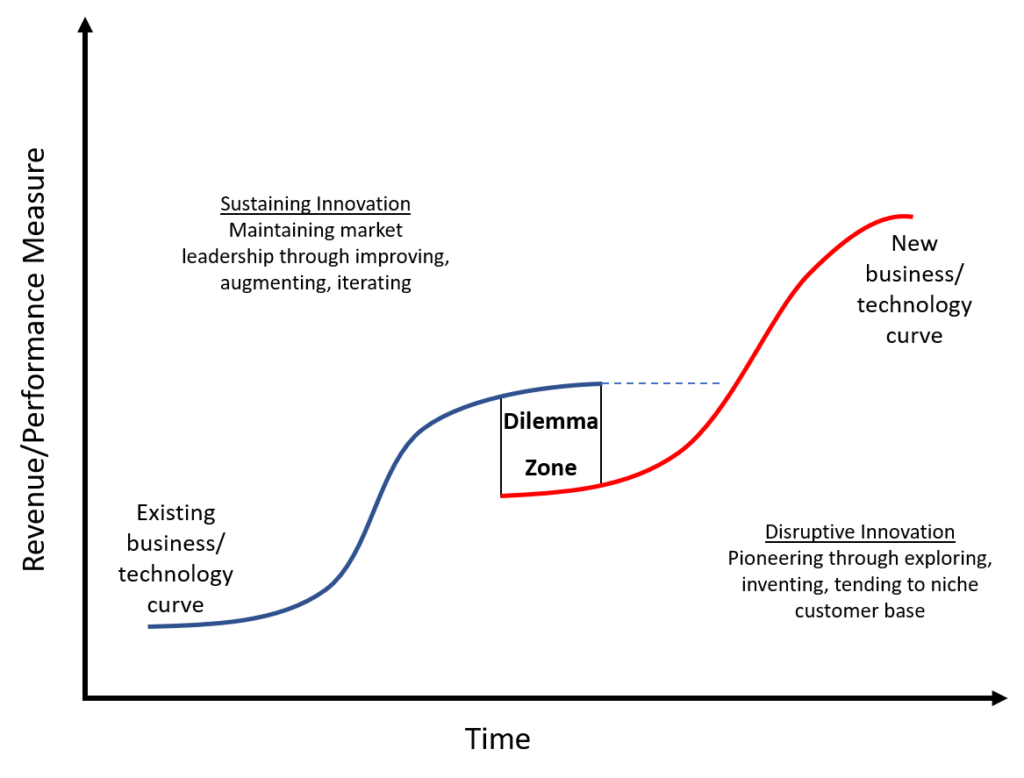

If you recall from 🏭 What's in a chip? Breaking down the Semiconductor Industry, we talked about the trend of splitting IDMs into pure-play foundries and chip design verticals, as well as the increasing strength of companies with a specialization in either. IDMs are companies like Intel that own both the design and the chip fabrication pipeline, and we predicted that IDMs (specifically Intel) would split into two separate verticals, either owned by a parent company or spun off separately. Recent news is pointing in that direction.

Last week on 12/29, Reuters wrote an article looking at how Third Point, a large investor in Intel at nearly $1 billion dollars, is pushing Intel to think strategically about the future, including our prediction of splitting fabrication and design. What’s more is that Intel is losing customers and is at risk of churning large profits in the cloud and personal computing as Amazon, Microsoft, and Google are bringing chip design in-house and relying on pure-play incumbents like TSM and Samsung, cutting out Intel completely.

As we continue to see specialization into the pure play foundries and fabless design, there remain the companies we all know best like TSM, Samsung, AMD, and NVIDIA, respectively, but the trend of larger cloud and hardware companies starting to design their own chips is something that I didn’t see as a threat to the design companies AMD and NVIDIA until now. This is another point on why the NVIDIA purchase of Arm makes so much sense. It’s not only an offensive play for licensing revenue and talent, but a defensive and strategic one, positioning them as the owners of an extremely valuable part of the chip design and manufacturing process: the instruction set.

So what does this specialization mean then for design companies like AMD and pure play foundries like TSM? Well, it means that the design of chips themselves is becoming commoditized, leading to more design competition, the pure play fabrication incumbents are becoming more entrenched with larger moats due to the price of market entry for new players, and the IP of the instruction set is becoming more and more valuable. In other words, everyone is designing and few are fabricating.

Design, Commoditized

Let’s take the first of those three: the design of chips is becoming commoditized. Why is this happening now?

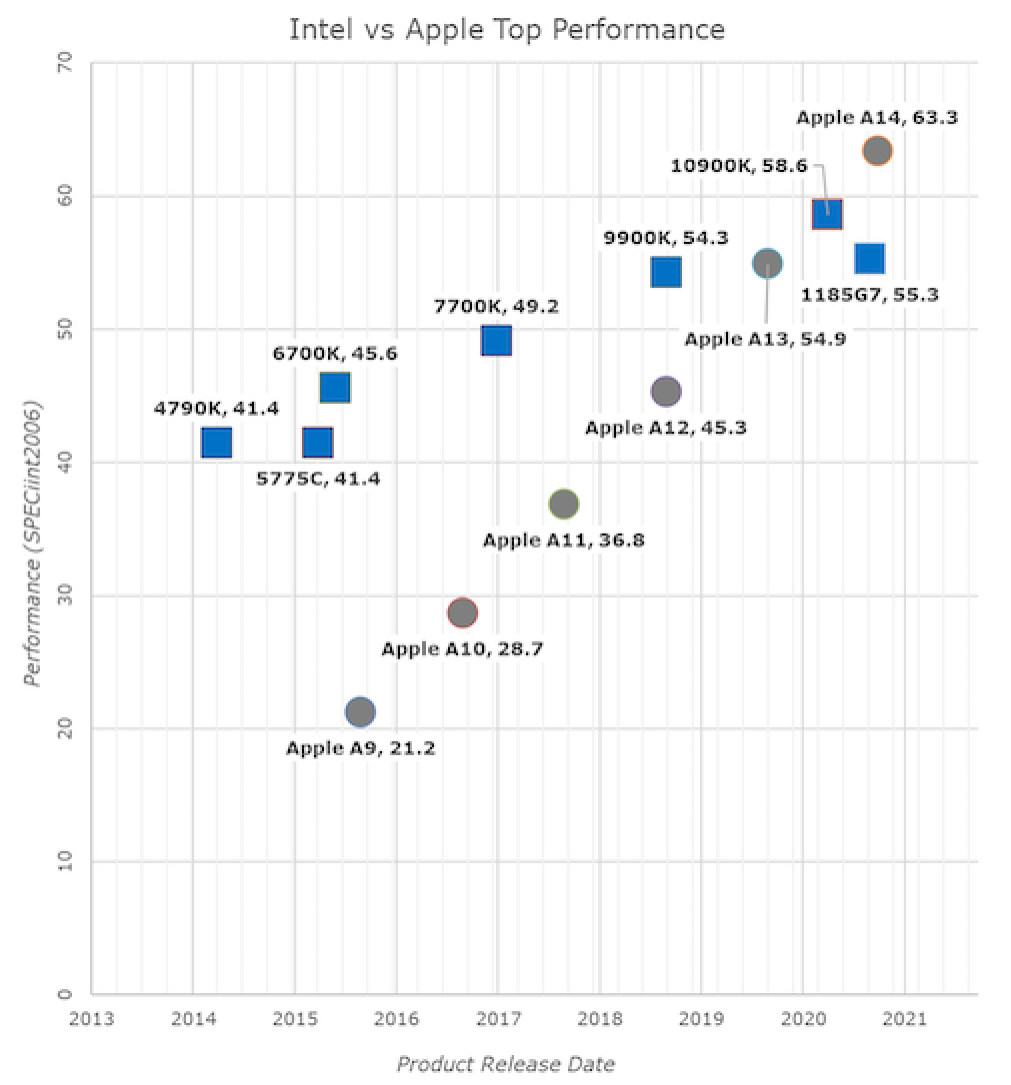

Well, there are a few reasons, the first being that the price and the reliability of outsourcing the manufacturing of your custom chips to a pure play fabricator has become cheaper and more reliable to where the quality and unit economics make sense. In fact, it’s estimated that Apple’s move to the M1 chip is going to save the company $2.5 billion this year alone. Intel was charging $200 per i5 CPU in the Macbook air, so Apple’s design of their own chip and outsourcing fabrication to TSM cost them 1/4th that at $40-50 per M1. It also happens to be much faster.

The second is that an instruction set like ARM is widely available to purchase licensing. It’s not proprietary to any one company like Intel which means you can increase competition by creating your own chips. Again, looking at the Apple M1 case study, Apple’s move in mobile towards the A series chips unlocked the move to the M1. Apple had been needing a chip with processing power and lower power usage. Therefore they created the A series on top of the ARM instruction set. To do so, they licensed the rights and moved away from Samsung mobile chips in 2010 with the iPad. Their vertical integration and control over the hardware and software made this easier, but they couldn’t have done this due to conflicts of interest in licensing from their chip providers. Now other chip designers hired into companies like Microsoft and Google can do the same.

The third is that innovation on the Intel x86 instruction set and chip fabrication has lost its edge and competitive advantage, leading other companies to come up with chips that better fit specific use cases, can be optimized, and are ultimately cheaper. This increases the company’s operating margin while simultaneously making their products better. Again, I know I am looking at Apple a lot here, but the point stands that their tight, vertical hardware and software integration means that they can focus on increasing efficiency across both. Another example is happening in the cloud with Amazon’s Gravitron Arm chipset that Twitter is moving towards. That new Arm chipset is lower cost and means they can increase margins. Microsoft is doing the same thing with their Surface devices and Azure cloud. Focusing on improved margins and performance is a double slam dunk for any company, and with Intel failing to do it better, they are set up to take their profits.

The combination of outsourced fabrication reliability, widely accessible Arm instruction set, and improved product performance and margins are leading companies to design their own chips. This has impacts on the IDMs, but also on the specialized chip design companies like NVIDIA and AMD. The cloud and personal computing is continuing to expand, and the cloud and hardware companies want to take advantage of increased margins, unfortunately edging out companies that focus on specialized design. That just so also happens to prove out for the pure play foundries.

Pure Play Incumbents are King

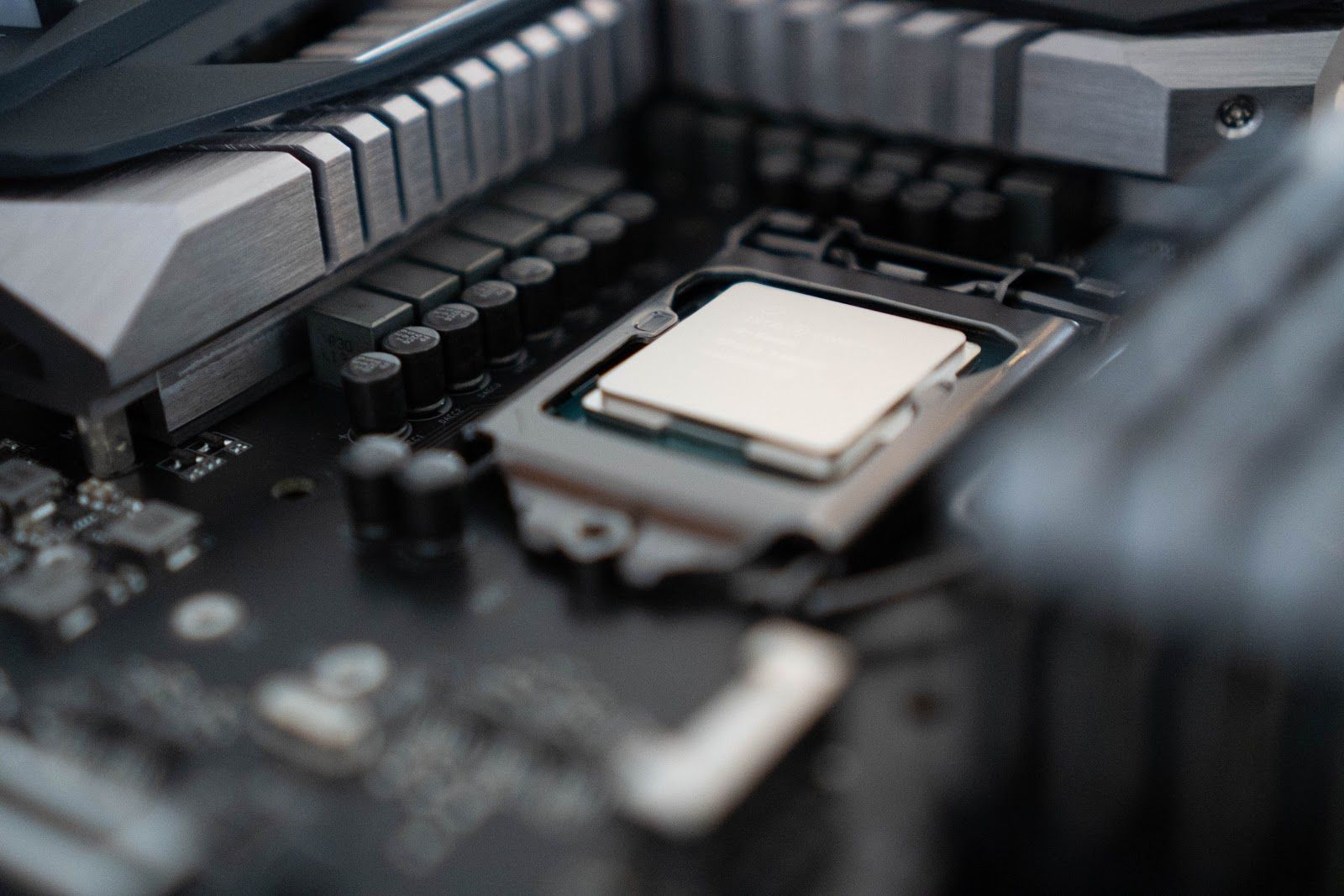

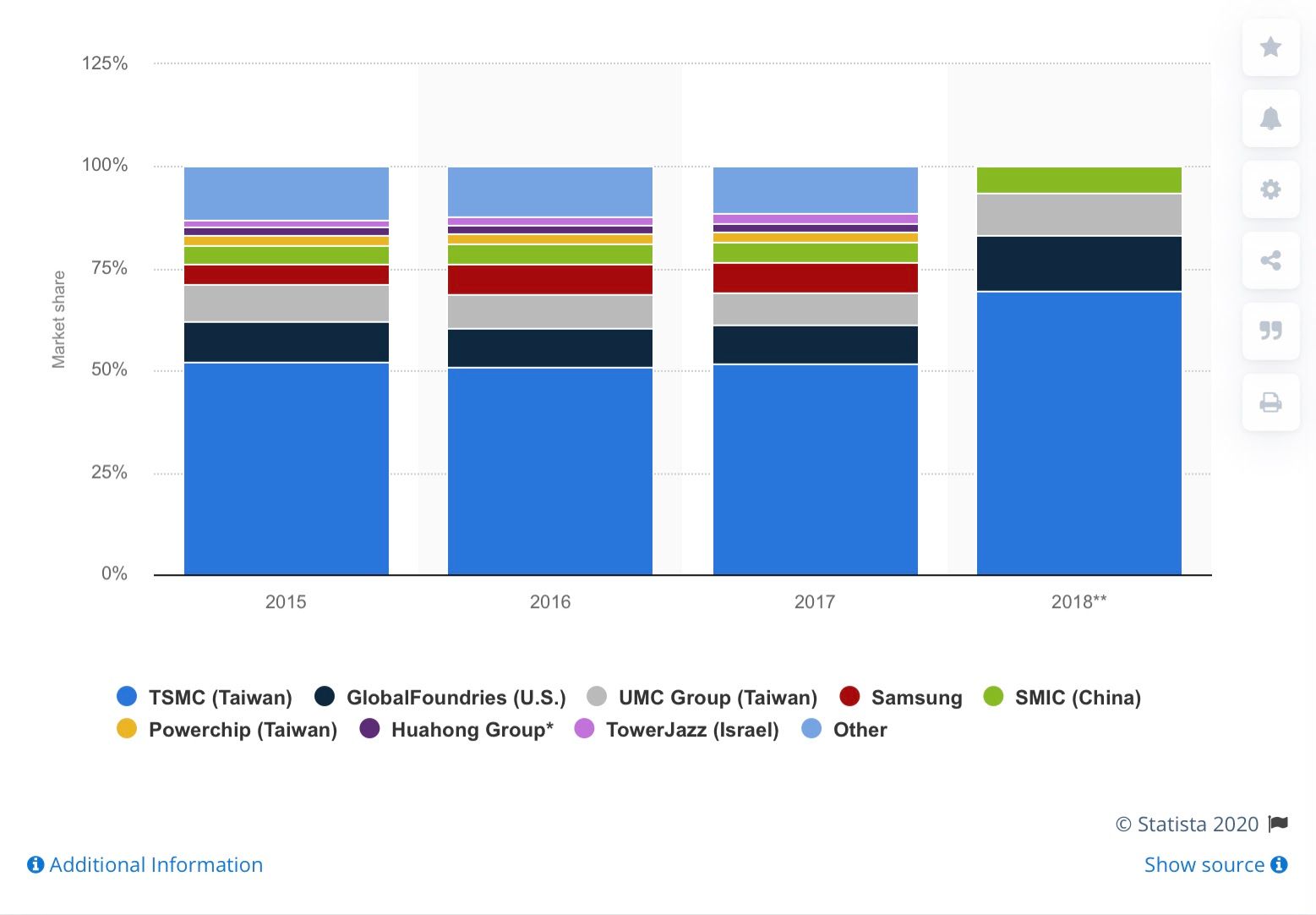

The second of three impacts from the split of design and fabrication is that pure play fabrication incumbents are becoming more entrenched with larger moats due to the price of market entry for new players, means that companies moving to design their own chips have to rely on the fabrication companies that can handle the specifics of custom chip fabrication, but also that have a reliable supply chain and manufacturing line. The number of fabricators that can be relied upon by the larger cloud and hardware companies moving to their own chip design is few and far between. The options for pure play fabricators are TSM, GlobalFoundries, UMC, and SMIC for integrated circuits like CPUs and GPUs. Samsung is also a major player, but is not considered a pure play foundry due to it also fabricating it’s own designed chips.

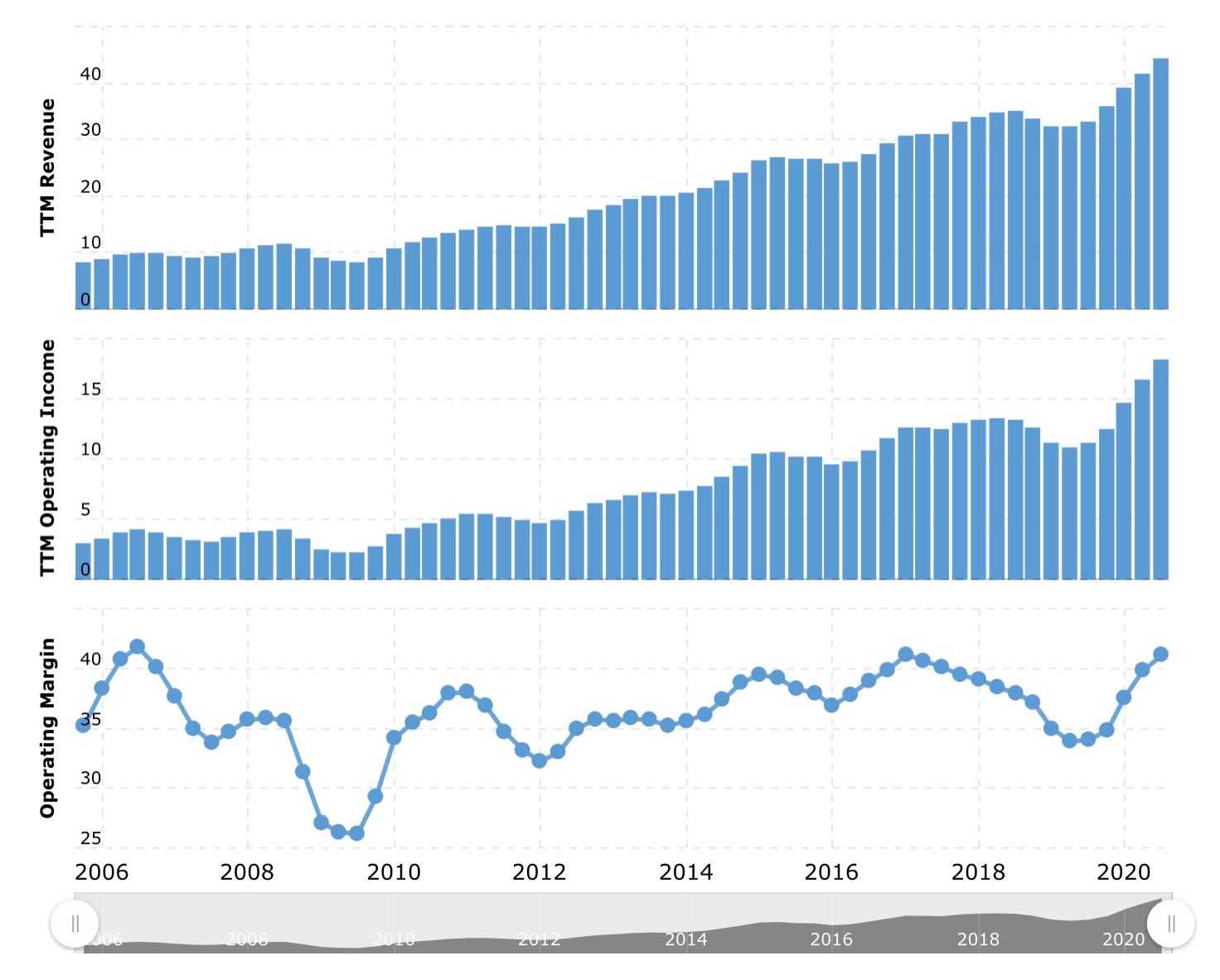

So as you can see, the options do exist and there is competition, but it’s consolidating. Each of the bigger players are becoming better and better at what they do, increasing margins along the way. Just look at the revenue, operating income, and operating margin for TSM over the past few years.

As the reliability and strength of these companies increase, so does the number of transistors on a chip and the cost of creating or augmenting a fabrication plant to keep up. We are seeing a cost of $1 billion to start a new fabrication plant up to the $9.3 billion that TSM used to create its Fab15 300mm wafer fab. It’s even estimated that the new plant in Phoenix will cost $12 billion and future 3nm plants will cost $20 billion. That’s a lot of cash to raise for any given company, especially for a new market entrant. Unlike the design and software side of the compute business, fabrication of hardware takes true operational and manufacturing prowess coupled with deep pockets. There are no 0 marginal costs. That’s the moat.

This is where I like to think of how Intel could capitalize strategically given their recent troubles with fabrication at the 7nm. Since the previous section looked at the design of chips becoming commoditized across cloud and hardware companies, Intel and other IDMs still have a very valuable business in fabrication over the long-term. If they are going to make a move, and if design is becoming less valuable as an asset, then the logical play is to try and compete with pure play companies. Even if you don’t spin off fabrication completely from Intel as a parent, fabricating chips designed by other companies will help Intel right the ship of its fabrication line, making it more efficient. This is where the value is heading, especially if you don’t own the instruction set rights for the new wave of default chip technology that Arm’s becoming. The good part? Intel could also have a branch to design their chips and not rely solely on their fabrication plants, and vice versa. They may lose out on some margin, but it’s better than staying the course.

Whoever holds the key, holds the power

The last of the three impacts of the design/fabrication split is important. The IP of the Arm instruction set is becoming more valuable as x86 is on its way out.

The x86 instruction set has been a standard in the industry after it was released in the late 70’s. There have been a number of variants on this instruction set to continue to push forward processors to 64 bit and so-on. The number of companies that can create chips with an instruction set like x86 is limited due to licensing — “...only Intel, AMD, VIA Technologies, and DM&P Electronics hold x86 architectural licenses, and from these, only the first two are actively producing modern 64-bit designs.” This meant that the number of companies that were able to compete with Intel in the CPU market was AMD, and why you see Intel 64 and AMD64 instruction sets.

With the standard moving to the ARM instruction set owned by Arm Holdings who doesn’t have any foundries, doesn’t produce its own chips, and only licenses out their technology, there is no conflict of interest causing Arm to charge outrageous amounts for licensing or withhold it altogether. Arm wants as many companies as possible to use its instruction set so that it can profit from licensing. That also means that the Arm instruction set is dethroning the incumbent, and if the strategy of the x86 instruction set is any indicator, it’s about to become that much more valuable to the owner. Given this, and the fact that chip design is becoming less unique, NVIDIA has its fingers crossed that it can hold the key along with it’s suite of software to stay alive long-term.

What’s next

So what we have now is:

- Commoditized chip design across hardware and cloud

- Stronger incumbent chip fabricators

- A valuable instruction set not owned by Intel and AMD

This leads to innovation in chipsets and better, more efficient experiences using personal computing hardware like the Apple Macbooks using M1 and cloud services like AWS Gravitron. Each of those examples is using the Arm instruction set, which not everyone agreed would happen, especially in the cloud, but it’s happening. This is the pattern that will continue as the flywheel of instruction set licensing, in-house design, and outsourced fabrication gets stronger and stronger.

So what does that mean for the industry?

Well, I believe we will see chip design companies move to differentiate themselves through other means of vertical integration like providing software that runs better with their chips, like NVIDIA is doing with software accelerated graphics. I also see this differentiation coming in the form of strategic footholds on various parts of the chip design and manufacturing process. While that likely won’t be at the fabrication level due to the cost of market entry, other areas of IP ownership over the instruction set like NVIDIA’s play for ARM will become a—no pun intended—arms race.

The cloud will also continue to move towards lower margins and increased performance, which will incentivize chip designers in the cloud companies like Microsoft, Amazon, and Google to design their own server-side chips, including both CPU and GPU, based on ARM. This will put further pressure on the chip design companies who will continue their differentiation and need to think further about how they can improve their own design offerings for the server and cloud. It also makes the instruction set worth more and more, making the $40 billion acquisition by NVIDIA look like steal.

I also believe that pure play foundries will become stronger and continue consolidation as demand for their custom fabrication increases along with the number of chips designed on the ARM instruction set. In the same way that we go to Amazon for a package because it's reliable and saves us money, so will the chip designers go to TSM or GlobalFoundries for chip manufacturing. I also assume Intel will make a play here and create a separate unit dedicated to fabrication of not only their chips, but using manufacturing capacity for others, improving competition further and driving down prices.

From an engineer’s point of view, this will also change the developer community a bit. Most developers are used to the x86 instruction set because it’s been the standard for so long. If your Macbook is running the ARM instruction set and you are developing for a server in the cloud running on ARM chips, then you are in the clear. Or if you are building a lower level piece of OS, you might need to build for ARM as well as x86. That being said, some folks thought that there would be compatibility issues with Windows and the Apple M1, but there has been a release of emulators that enable x86 and ARM instruction set compatibility. Of course. While there might be performance issues with said emulators while ARM moves in on x86, it’s something companies are incentivized to make happen given the margins. If the server moves to ARM, so will the device (and vice versa), making compatibility a non-issue in the long-term.

As you can tell, I enjoy thinking and writing about the semiconductor space. It’s a relatively mature industry that is undergoing a lot of change in a short amount of time. The incumbent Intel who has been winning for a long time has become complacent and is being squished both on design by nimble companies that move fast and fabrication pure plays that have mastered manufacturing. Even those nimble companies who focus solely on design need to differentiate now in order to maintain value in the eyes of hardware and cloud companies.

If I have to leave you with one thing, it’s that we can’t forget that no matter what industry we are in, complacency is dangerous and breeds failure — even when success seems like it’s coming easy.

Disclaimer (full)

Views expressed in “content” (including posts, podcasts, videos) linked to or created in this newsletter, website, posts, or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of any person, company, or entity I am affiliated with or each entities’ respective affiliates. The content is not directed to any investors or potential investors, and does not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.