📈 Ubiquity and Bitcoin's Return

A refresher on Bitcoin, its value, and how we got here.

You may have seen that the price of Bitcoin is climbing back to its Christmas 2017 high of ~$20k. At the time I am writing this piece Bitcoin is sitting at $18,552.33 per coin [0], up roughly 60% over the past 3 months and a whopping 155% up over the past year. Not bad.

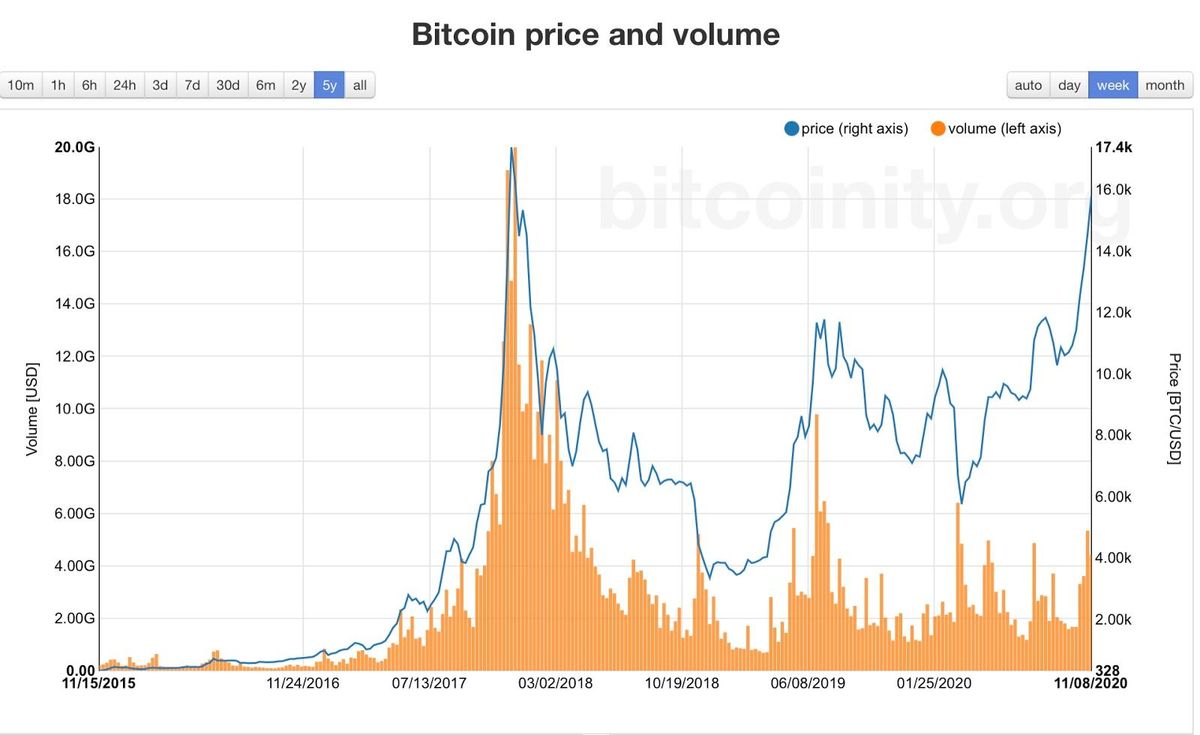

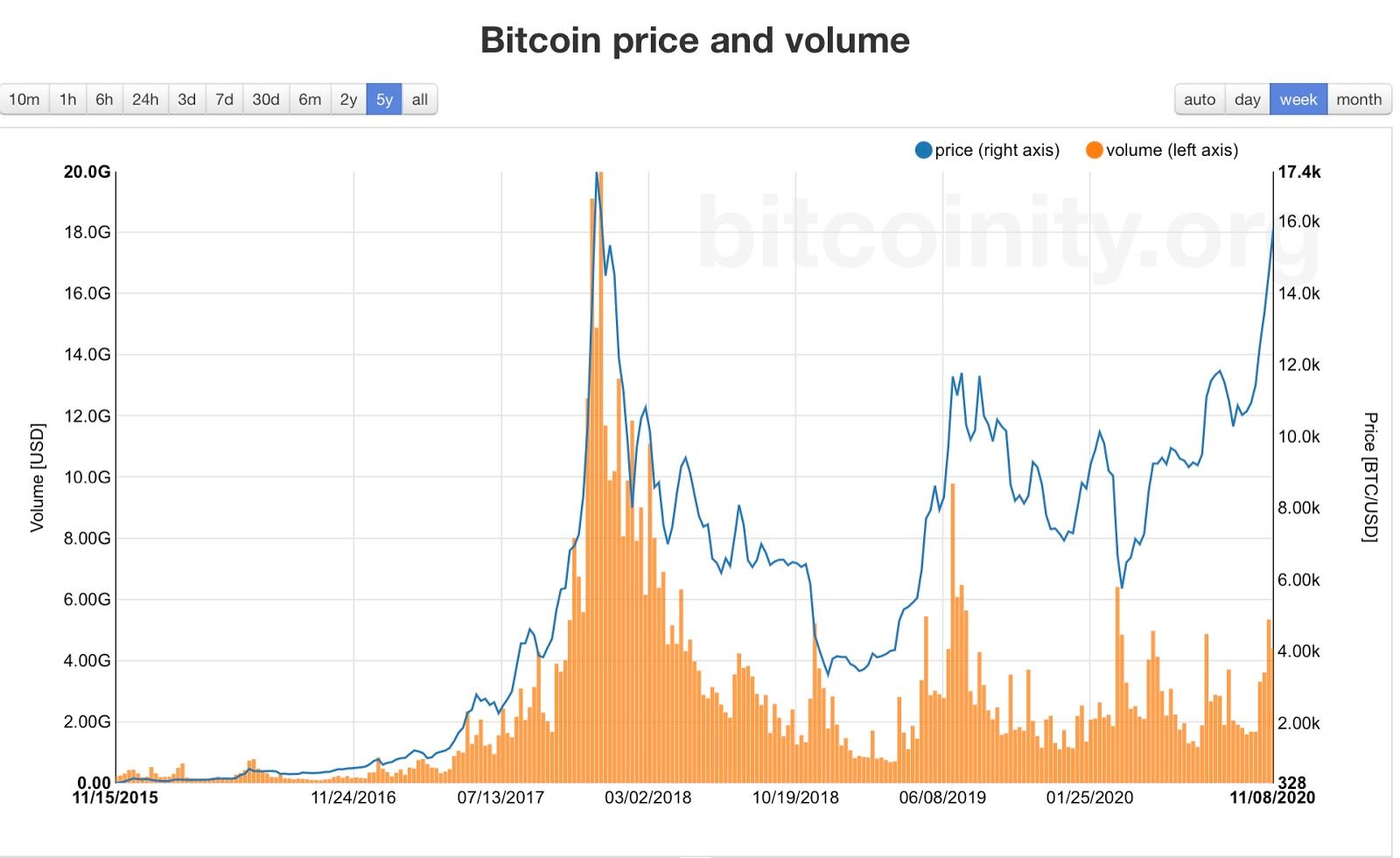

What’s interesting to me here is not necessarily that asset prices are fluctuating and inflating — we’ve been seeing that across the stock market since the initial COVID drop in March — but that the cryptocurrency asset class and its increase has flown a bit under the radar from what used to be surrounded by hype. I resigned, as many have, to the fact that said hype from 2017 had worn off and crypto lost its steam as a speculative play in a get-rich-quick scheme. In a world with democratized financial tools like Robinhood, we’ve seen a huge influx of traders into the stock market that’s been widely reported on, but we haven’t seen the same when it comes to the trading volume with Bitcoin or other cryptocurrency exchanges.

In fact, when comparing the trading volume to price over the past 5 years, we can see that there is an evident correlation between each during the mania in 2017, but from 2018 on we see that the trading volumes are consistently low when compared to price.

That’s curious and there are a few reasons why we are seeing a pricing comeback, but before we dive into that, let’s get a quick reminder of Bitcoin — cryptocurrency — fundamentals so we can explain it to our relatives at Thanksgiving.

What’s Bitcoin?

If you already have a clear understanding of cryptocurrency, feel free to skip. For everyone else: cryptocurrency is a digital asset class used as a medium of exchange (i.e. cash) and store of value (i.e. gold).

It is purchased and sold on cryptocurrency exchanges in the same way as the stock exchanges. It can also be used in exchange for goods and services, like any other class of asset. Since all crypto is digital, there are many other usages that are being created everyday, such as smart contracts, but we won’t focus on those here. At the high level, it’s a currency that can be used for purchasing goods and speculating that fluctuates in value in the same way we see the value of the US dollar, gold, or stocks.

While cryptocurrencies at a high level, when looking at value and usage, are similar to other asset classes, they are different in a couple of ways. The first is that they are inherently digital, unlike most (China is releasing their first all digital currency) currencies. The second is that they are mined, meaning that people need to provide value to the Bitcoin network in order to unlock more coins. More on that in a bit.

So what about Bitcoin? Bitcoin is the first and most successful cryptocurrency to date. It was created in the famous 2008 Bitcoin whitepaper [1] after the 2008 financial crash when it was seen that the centralization of banks increases the fragility of the global monetary system. In the whitepaper, the creator, Satoshi Nakamoto, who still remains anonymous (there is much speculation on who or what that anonymous handle refers to), laid out a digital currency based on cryptographic hashes (unique tokens) and a peer-to-peer network of computers that would enable bitcoin to be decentralized while solving the double-spend problem where you can use the same digital coin twice.

That brings us back to the second difference of cryptocurrencies versus typical asset classes. When we talk about a peer-to-peer (p2p) network, we mean that there are many decentralized computers that allow the network to exist. It does not rely on one centralized computing system like a bank, for instance, to maintain the inputs and outputs through a ledger. That ledger exists on many computers who work together to ensure that transactions are safe, true, and only happen once. The way they do that is verifying transactions through a blockchain, or a chain of transaction groups, each with transactions that are linked through a hash, or unique token that includes information from the previous and current transactions. This verification and validation is called the proof-of-work through mining.

This is where it gets technical really fast, and while I think it’s worthwhile to read through the whitepaper [1] to understand exactly how Bitcoin works at the technical level, the high level understanding of how this fits together is more important to understand how Bitcoin functions, why the first developers were incentivized, and why it’s valued.

Bitcoin’s Value

Let’s start with a list. Bitcoin’s value is derived through similar functions as the typical assets like gold and fiat money [2] (USD):

- Rare: Like gold, there is a limited amount of supply (₿ 21,000,000 to be exact).

- Medium of exchange: Like USD, can be used to buy and sell goods.

- Investment hedge: Like both USD and gold, you can use it as an investment hedge.

- Ubiquitous agreement: Like both USD and gold, society assigns it the value they believe it’s worth.

The last point here is frankly the most important. Yuval Noah Harari says it best in Sapiens [3] —

“Money is the most universal and most efficient system of mutual trust ever devised.”

Imagine back when there were small economies, let’s say villages as the origins of coin and paper money date back to 600 and 700 B.C., respectively [4]. These village economies didn’t work on a global or even regional basis like we see today. As such, they relied heavily on inter-village trade based on specializations. If you were a baker, you traded bread. If you were a blacksmith you traded your skills. As these economies grew, they needed to become more efficient in trade in order to flourish. Money solved that. The great part? If you needed bread, you didn’t need to worry if the baker needed what you had to trade. You would just use the generic currency.

At the same time, this worked because everyone collectively believed in the value of the generic currency. It’s the ubiquitous agreement in the currency’s value that allows it to become a medium of trade, and it’s that ubiquity that fosters the efficiency necessary to sustain continued specialization and growth of economies.

The reason why we are talking about this is because of a question recently posed to me: who sets the price and who creates the value of Bitcoin? Well, the same ubiquitous agreement on the value of the currency makes it real to those who buy and sell Bitcoin or use it to purchase goods. The same way a village, city, nation, and the globe agrees on the relative value of the US dollar. Those who are buying and selling Bitcoin let the market determine the value of each coin.

In fact, the old anecdote goes that an early Bitcoin developer purchased 2 Papa John's pizzas for ₿10,000 in 2010 [5], a value at the time that made sense at under one cent per coin, but now looks foolish at a whopping $185 million USD by value. Therein shows that the asset class fluctuates in price, but the Papa John’s delivery driver and the developer agreed at that time that the value of the pizza was worth the value of 10,000 coins.

Why is this important? Well, you can disagree and argue about the value of Bitcoin, but that’s not the point. The point is that there are some people, companies, and government entities that believe in digital currencies like Bitcoin and other cryptocurrencies. They are willing to pay a certain price for a coin, trade that coin for some form of goods or services, or willing to invest in it as a store of value. Those people and their collective agreement make Bitcoin valuable.

Beyond the dollar

Ok, so we know some of the fundamentals about currencies in general, but Bitcoin and other cryptocurrencies are valuable for reasons outside of normal fiat money:

- Decentralized: Doesn’t rely on one single point of failure, like a bank.

- Digital: All digital, and can have functionality like contracting built in.

- Global: Does not respect country borders.

- Anonymous: Like cash, it’s anonymous, but it can be sent to anyone on the planet over the internet.

When we talked before about the value of Bitcoin, and therefore the price of Bitcoin, we looked at the foundation of money as the ubiquitous agreement of a group to make it viable, but how does that start? Well, for Bitcoin, the above reasons rang true for those who wanted to see a decentralized government after the 2008 market crash, but also for folks who wanted anonymity when trading bitcoins. The latter was how it all started and the former was a huge growth driver.

As stated before, the Bitcoin network works as a decentralized, peer-to-peer network of computing machines that maintain and verify transactions. In order to start Bitcoin, there needed to be an incentive to be a part of the network, which is where mining comes in. Mining is where someone can provide computing power to verify transactions. Once the number of transactions hits 1MB of memory, the algorithm looks at the machine in the network that solved the answer to a numerical problem first. If your machine did, then you get a Bitcoin reward.

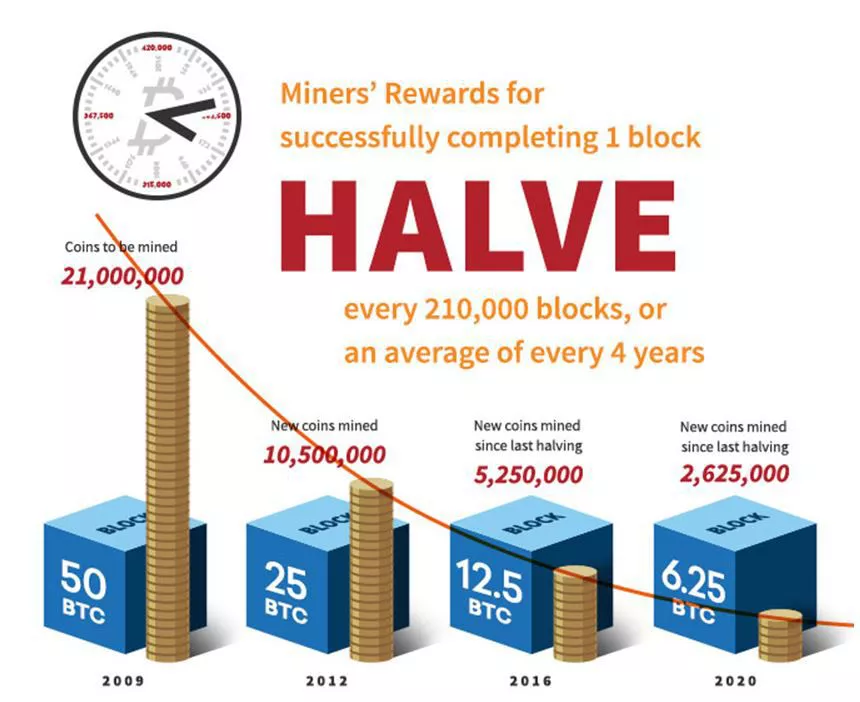

This seems complicated and insane when you look at typical currencies, but it was the perfect storm of incentivization for the computing power needed to verify transactions and decentivize bad actors in the network. Developers that wanted to be a part of the Bitcoin network for reasons against centralized banking or reasons for computation and engineering interest were now able to be rewarded for their efforts, and they were the first to kick it all off. But starting the network is only half the battle, especially as it becomes less and less lucrative to mine as the years go on due to rewards halving every 4 years.

Like in any marketplace business, there is a chicken-and-egg problem of supply on one end and use case on the other. As Bitcoin started up and gained in popularity, exchanges like Mt. Gox started up and allowed people to trade Bitcoin which helped the currency usage. The anonymity of the currency also helped Bitcoin find it’s home on the dark web within marketplaces like the Silk Road where people could buy and sell goods over the dark web without being tracked. This was (is?) mostly used for illegal goods, and is where Bitcoin’s value started to go up given popularity, and again: the collective agreement of a group in the value of a currency.

As the illegal dark web markets started using more and more Bitcoin to buy and sell, and as the exchanges grew in popularity, so did interest in Bitcoin as an investment. People started buying and selling coins as a store of value, like gold, and in 2017-2018, had a digital gold rush where the value of Bitcoin rocketed 20x from $1,000 to $20,000. It crashed, but maintained enough value and steam in the market that it’s back up to near its 2017 high. It also maintained enough steam to get picked up by more consumer focused stock exchange and banking applications like Square, Robinhood, and PayPal

So if you want to mine bitcoin, you can help the network maintain using your machine’s computational power, which is what keeps the currency decentralized. If you want to just buy it or sell it on an exchange like Coinbase, you can do that too. Or, if you want to ignore Bitcoin completely because you don’t believe in it’s value, then that is ok as well.

Where we are now

Bitcoin and cryptocurrencies are a tricky subject. Not only is it technically complex for those not familiar with software engineering (i.e. hashes, distributed systems, cryptography), but it’s also a major shift away from the centralized banks we have become so accustomed to.

On the other hand though, it’s starting to pick up steam in it’s overall value. Some have a hypothesis that there is a supply side problem due to restrictions on mining in China who control 75% of the Bitcoin mining [6]. Others think that there is a hedge play happening for big investors [7]. Many think that it’s the fact that PayPal and Square, amongst others, are starting to legitimize Bitcoin through platform support for buying items with Bitcoin [8] and a $50 million investment [9], respectively. Another term is also being floated around called Defi [10], or decentralized finance, that encompasses all types of cryptocurrency, digital assets, blockchain companies, and any other play to upend the current centralization of banks which may be contributing to the shift.

Regardless of what the answer is (I expect it’s a little bit of each), the volatility of cryptocurrency is real and valuations are sky high and based on projected value, much like the trading we have seen with Tesla (evident in their near 1000 P/E ratio). However, it’s clear that people believe that it’s valuable, whether you believe it or not.

As I mentioned at the beginning of this article, Bitcoin is trading near its all-time-high of $20,000 USD, but things are different this time around. The amount of trading volume isn’t matching the overall price and we aren’t hearing about it in the news nearly as much as we had back in the manic Q4 period 2017. Companies are starting to legitimize the use of Bitcoin, bigger players are holding larger positions, and COVID is upending a lot of our traditional modes. You are seeing more and more major banking players are coming around to cryptocurrency, decentralized finance, and Bitcoin as a hedge.

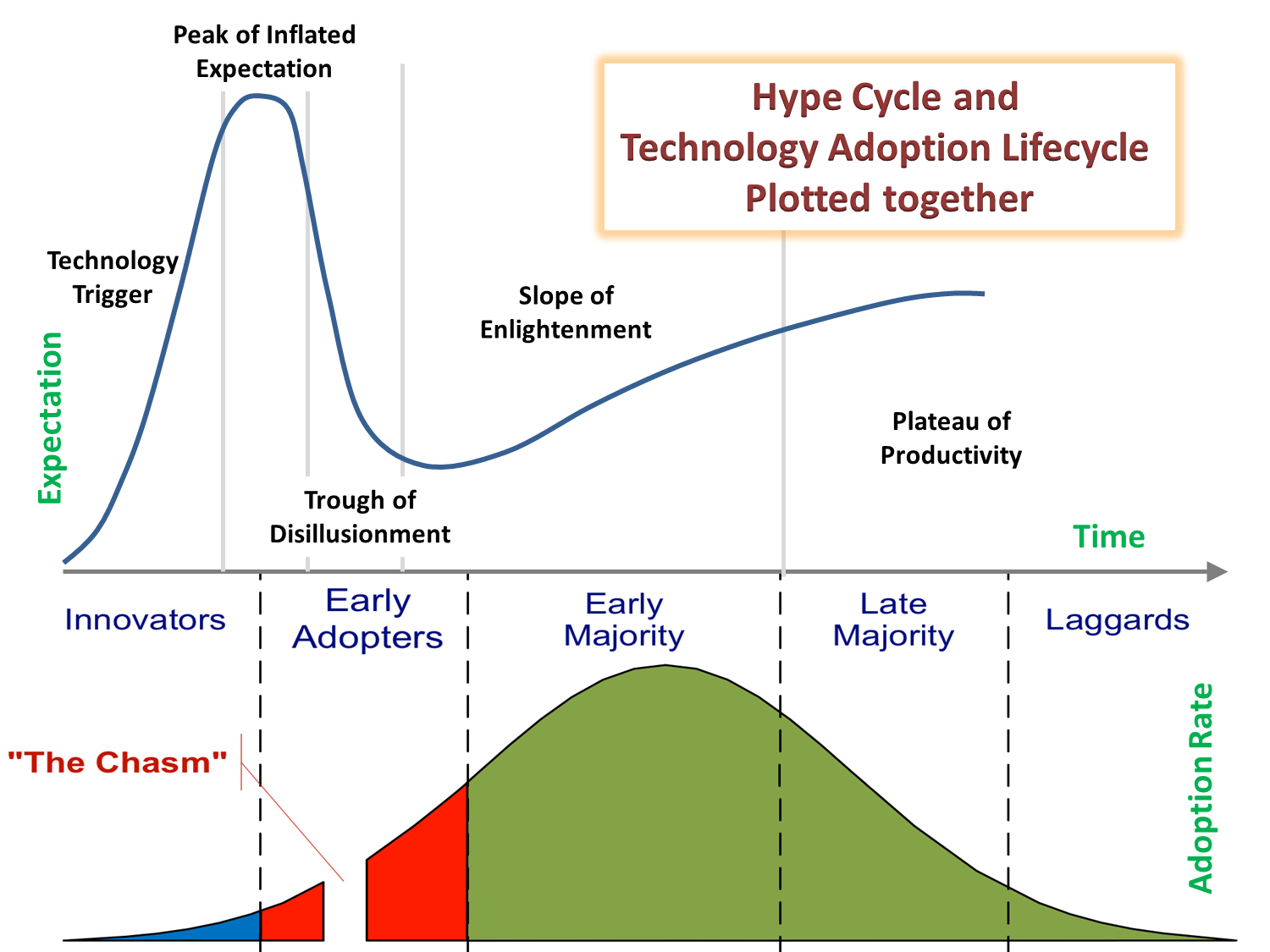

While we might not be in the same place we were back in 2017, things seem to be trending in the direction we see with the technology adoption curve. High hype cycle with a trough of disillusionment followed by the slope of enlightenment and into the plateau of productivity.

As more and more people, companies, and governments start to legitimize a form of cryptocurrency like Bitcoin, the collective agreement becomes more ubiquitous and therefore more entrenched. Who knows what’s going to happen to Bitcoin. It’s too hard to tell, and anyone who can for sure tell you one way or another is placing a bet. The industry is shifting quickly and that bet on Bitcoin is a bet on technology adoption, ubiquitous agreement, and a successful incumbent in the cryptocurrency space. No matter what side you are on, given the growing collective agreement, swaying of popular opinion, and quick evolution of the cryptocurrency and fintech space, it’s hard to ignore that how we think about money and assets is changing forever.

“There are no gods in the universe, no nations, no money, no human rights, no laws, and no justice outside the common imagination of human beings.”

-- Yuval Noah Harari

— Dejno

[1] https://bitcoin.org/bitcoin.pdf

[2] https://www.investopedia.com/terms/f/fiatmoney.asp

[3] https://www.ynharari.com/book/sapiens-2/

[4] https://www.investopedia.com/articles/07/roots_of_money.asp

[5] https://www.investopedia.com/news/bitcoin-pizza-day-celebrating-20-million-pizza-order/

[6] https://www.coindesk.com/bitcoins-rally-supply-crunch-in-china

[8] https://www.ft.com/content/b18335fe-1926-48f5-9522-c99d27b07ade ($)

[9] https://squareup.com/us/en/press/2020-bitcoin-investment