Thoughts on the Salesforce <> Slack acquisition, platform value, and why “who got the better deal?” is the wrong question.

This past week Slack was acquired by Salesforce for $27.7 billion in one of the largest ever acquisitions of a SaaS company at a large 2x premium on top of Slack’s market cap of $13 billion in mid-November.

Since the announcement, there has been a flurry of articles and discussion on the value of that acquisition to each party, if Slack sold too early, and why Salesforce’s stock price went down in the short-term as a result. Most of what I have read hits on a few main points around valuations, sale price, and the competition with Microsoft. While these are great points that need to be considered, I fear it misses out on the areas of product, data, and platform value that Slack brings to Salesforce and how Salesforce’s resources can help bolster Slack’s ambitions. This was a good acquisition on both sides, in my opinion, and I want to dive into why.

The value of Slack

Slack has value right out of the gate when you use it internally within a company. It immediately lets you communicate in real time with everyone in your company through low friction concepts like channels, threads, and reactions. This is the core of Slack, which has been deemed an email killer, and is even more core to remote working than ever from the COVID push.

The problem is that core messaging is becoming a replicable commodity and while I don’t believe that internal messaging can kill email as it stands (for reasons of response expectations, message formatting, and length of message), I do believe Slack is well on it’s way to creating serious network effects with one of the most differentiated features of a chat we have seen in the enterprise: cross-company messaging.

In the same way that you might email back and forth with a client or consultant, or use other project management tools to coordinate work across companies, Slack’s real time messaging, it’s adoption rate by other companies, and it’s ease in opening up communication across companies is changing the way we work and conduct business.

For example, if you work in a SaaS company like Shopify that has partnership and integrations with other companies like Stripe, then you need to communicate and coordinate between the two silos somehow. Instead of meeting in person or emailing word documents and pdfs back-and-forth to solidify requirements, send status, and ask clarifying questions, you can now open up Slack to work directly with someone from the other company in realtime, letting you get your answers answered quickly, and unblocking you so that you can both make progress on things like product development and contracting.

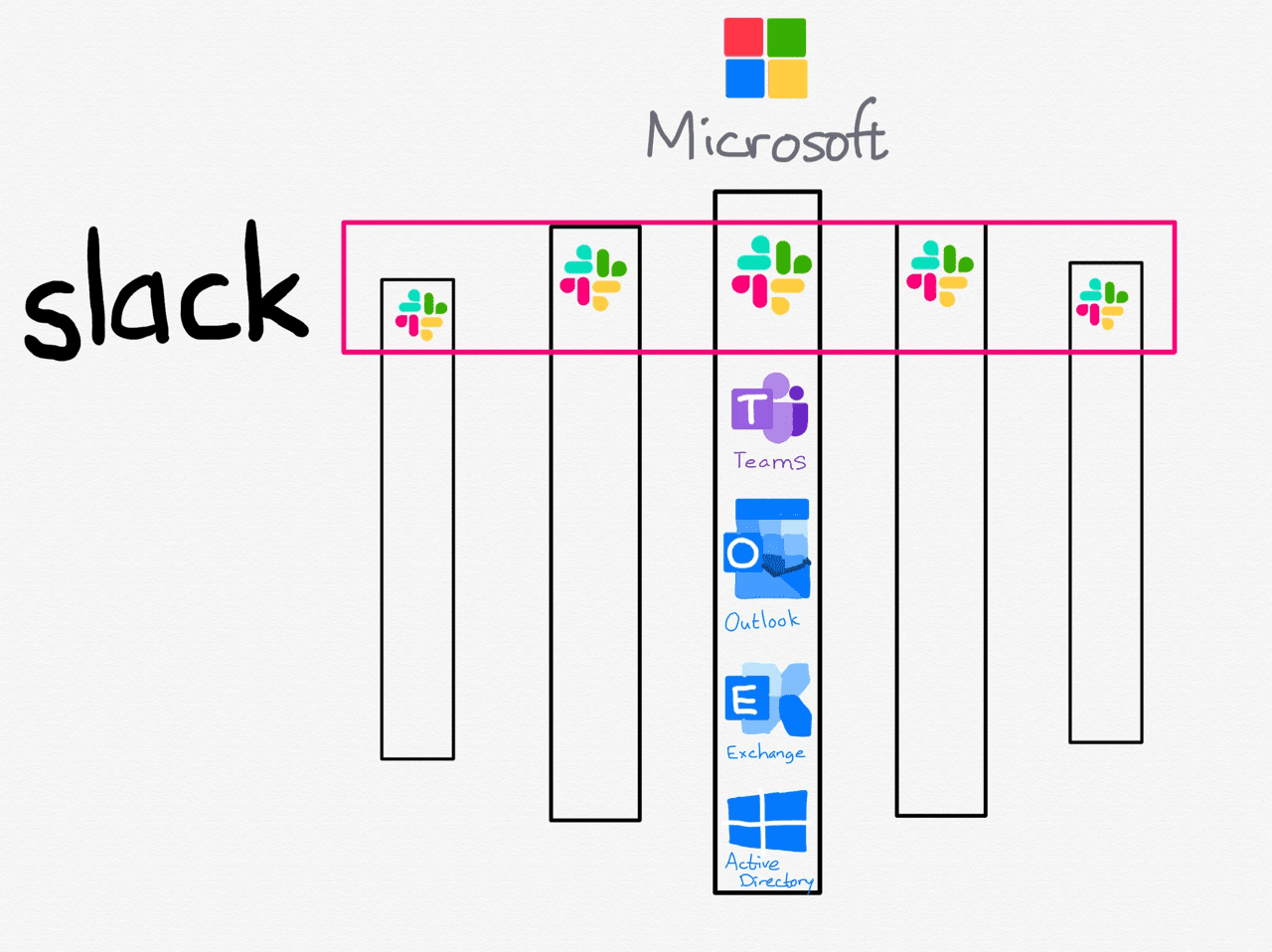

As you can see in the above visual from Ben Thompson’s Stratechery, through this cross-company messaging, and more like a social enterprise play, Slack is developing a horizontal, inter-company messaging platform by connecting companies that would otherwise use traditional communication platforms like email to message back and forth.

I have seen this first-hand at Stripe where we communicate a lot with our enterprise customers as we work on integrations together. These integrations are not always simple, and require customization to meet the needs of our users while they help improve the evolution of our products and roadmaps. On the engineering team, it takes opening up a Slack channel to speak directly with an engineer at the other company, effectively reducing the amount of overhead and churn to 0, improving iteration speed, and reducing time-to-market.

This has been such a monumental shift in inter-company communication that Microsoft Teams came out with a similar version to augment the clear vertical enterprise strategy of the Office 365 and Teams Suite. This is competition, and one of the major reasons why Slack is so valuable, but it’s not just Slack’s core offering why Salesforce is excited about the well-timed acquisition.

The additional value that Salesforce is seeing is three-fold, (1) Slack has created a developer community through its app integrations, (2) Salesforce sees Slack as a large piece in the puzzle of end-to-end software suite powering the workplace, and (3) Slack has data on how people work within companies and what tools they use most effectively to get their work done.

Developer Platform

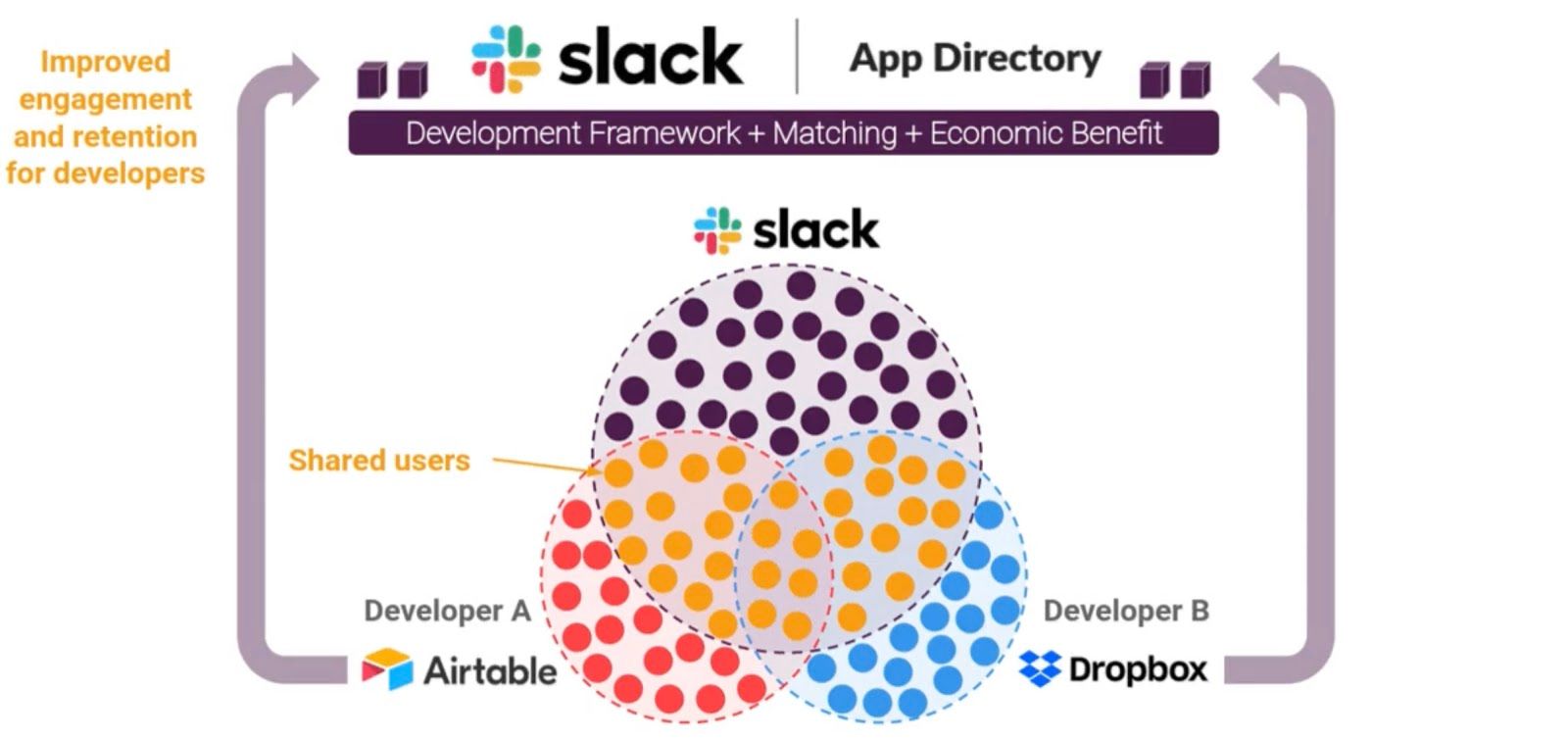

The first of these three is extremely important. It’s hard to build a developer community around a platform because you need incentives to do so. It’s a chicken-and-egg problem where you need users on the platform to give developers incentive, but you need enough features and integrations to provide user value.

In Slack’s case, they created a large user base from the core messaging product that was easier to use and set up when compared to rivals. That’s where the developers came in. Those users have overlapping needs for other SaaS products in the workplace, like Airtable or Dropbox, incentivizing those companies to provide an easy integration into Slack as the core messaging system.

From a great article on economic incentives for building platforms, Slack is a focused platform with integrations, in which those integrations allow economic benefit to both Slack and the developers through improved engagement and retention of those users that are shared across the integrated products. Developers know Slack helps their product stickiness. Now imagine Salesforce upselling or even bundling free heroku serving for Slack apps to the existing Slack developer community.

There is also a competition and strategy aspect to app directory platforms and the apps companies are willing to develop. For instance, Google Workspace, the workplace productivity apps like Docs and Sheets from Google, does not have integrations with Microsoft Teams. Similarly, Microsoft has only a select few of their integrations on the Slack app directory, and funny enough, one of those is Teams. To put the app integrations to numbers, there are over 2,000 app integrations on Slack and only 700 on Microsoft Teams. Slack’s value here is that the community isn’t just there, but is strong from developers not seeing them as a threat, but seeing them as a tool to share customers.

Vertical Puzzle Piece

The second reason why Salesforce sees value in Slack is that it helps create the same vertical structure that Microsoft Office has internally. If you recall the image above looking at Slack as a horizontal entity vs Microsoft’s Office Suite as a vertical, you can see a high level overview of the key parts of communication (Teams, Email, Exchange, and Active Directory) that come together to create a moat. You don’t ever have to leave this moat when you are at work when your company buys into the Microsoft Suite. If Microsoft is doing its job correctly, it will cover all of the workflows you might experience on a day-to-day, and make it seamless with integrations across the vertical. Think Apple products.

Salesforce is looking to do the same through the use of it’s CRM, Workflow, and Cloud tools, and it helps to fill a massive gap where the dream of Salesforce Chatter once looked to fill. It needs a hub for all of the spokes within its offering, and Slack’s platform and integration model has already proved out through the existing Salesforce integrations that it is a crucial part to the new form of working.

Data

The third reason is data. Slack is a platform that other companies hook into through their app integrations, and for each of those app integrations, Slack has usage data from each of those companies. That means that Salesforce and Slack now have a treasure trove to sift through and figure out how to adapt the current Salesforce offerings not just from the Salesforce integration data, but from the data of other companies who are building SaaS cloud products.

Does that user who uses Google Drive integrations also use Salesforce? What does a workflow typically look like in Slack for a Salesforce user? That is powerful, and one of the only reasons I could think of for the DOJ to block this acquisition. Salesforce needs to be careful on this if they want to stay out of the antitrust crosshairs, a reason why they may have timed this acquisition to when they did.

The Value of Salesforce

Salesforce and this acquisition also has value to Slack, mostly that $27 billion is a large premium over the market cap for Slack when they have $800 million in annual recurring revenue, but also that Salesforce can provide them with the backing they need to realize their vision in the face of uncertainty and stiff competition from Microsoft. Slack, given their 40% drop in market value from their initial offering price leading into 2020, was ripe for the taking because it needed the lift.

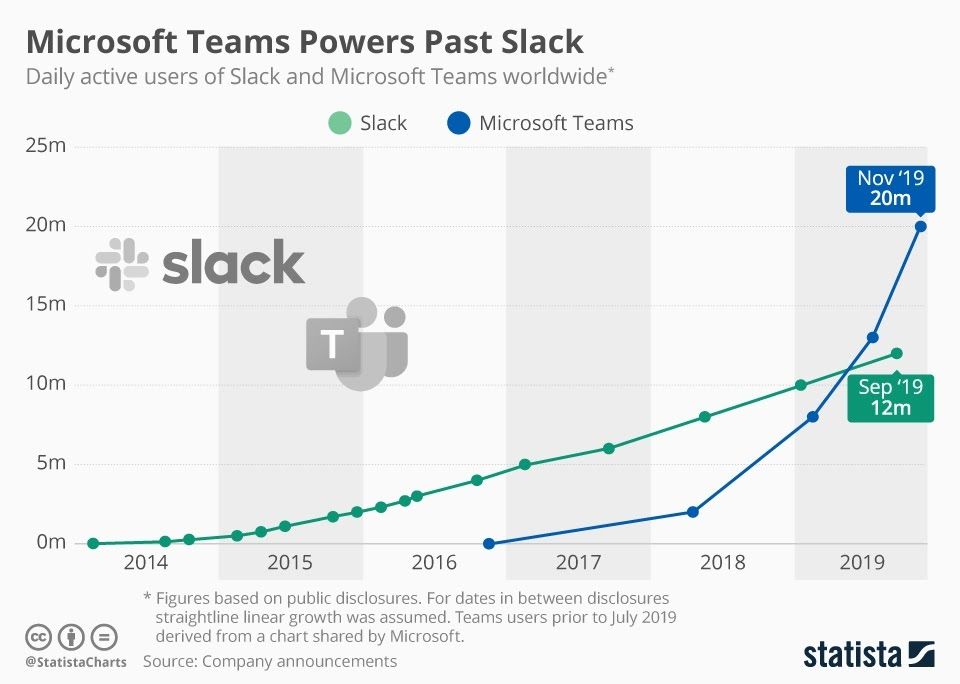

If you don’t recall, Microsoft Teams came out years after Slack. Even with a 2+ year head start, Slack found themselves falling to Microsoft Teams in terms of Daily Active Users and growth rate. When you have an existing workplace collaboration suite where you can upsell, or in the case of Teams, give the offering away for free in a bundle, it’s easier to convert an already large user base than it is to acquire users through traditional enterprise sales and word-of-mouth.

With that competition from Microsoft heating up, Slack had a lot of uncertainty to deal with. Microsoft had a huge leg up here with its resources that Slack couldn’t compete with. Even when COVID hit, Slack was lumped together with other SaaS products like Zoom but didn’t see the massive lift of its SaaS counterparts.

This is the entire point of why the Salesforce acquisition will help Slack to realize it’s vision — in the same way that Microsoft bundled Microsoft Teams within Office, Salesforce now has an easy upsell of Slack with it’s existing workplace offerings like it’s core Cloud CRM. Slack is going to have a new firehose of users with any bundling from Salesforce, and Salesforce is absolutely going to do this since Slack is the offering that helps to compete in the end-to-end workspace vertical. Even for those companies that need additional workplace tooling not offered by Salesforce, they can leverage the multitude of other SaaS products that can integrate seamlessly with Slack as we saw above. They are investing in Slack’s future growth, which is what they needed.

To make this possibility even more salient, Salesforce has a large, and well-equipped veteran salesforce who can accelerate the adoption even further than typical self-serve bundling. It’s been stated that one of Slack’s major missteps (of very few, if any) was not creating a large enterprise sales team earlier, and simply relying on product word-of-mouth and self-serve for many years. While that was a strategy that helped them build up a brand with startups, they missed out on a lot of the market entry into enterprises who likely now use Teams. That can’t be easily proven, and is easier said in hindsight, but for each sale that Salesforce has, they can now bundle Slack for which Slack will see larger growth in the enterprise and continue to build a moat. For large accounts they missed out on, this becomes extremely lucrative to both sides.

So really, Slack’s fear of being trampled by Microsoft Teams and edged out slowly will be mitigated by working with a company like Salesforce who has a big pocket book and the resources to help Slack grow its DAUs and number of developer app integrations in the flywheel that is a two-sided platform. They also now have Salesforce’s large user base to convert to users on Slack. Who wouldn’t want that support?

Opposition

The opposing arguments to this acquisition are many, like “Salesforce overpaid”, Salesforce might not be the right fit”, and “Slack had so much potential that’s now gone.”, but I don’t see it that way.

First off, Benioff in 2016 lost out in a bidding war for LinkedIn to Microsoft. Sparing the usual chatter about competition with Microsoft, Benioff sees value in Slack and is learning from his mistakes. He didn’t want to lose out on this deal the same way he had before. I do believe that, and given that Slack is the part of a new enterprise style of software that rules by seamless integrations from the collective, there is long-term value in the acquisition that may not be realized on day 1.

Secondly, “Slack losing potential” as the argument against the acquisition is all in the details of how the acquisition happens internally. If Slack is brought into the suite of Salesforce products and doesn’t operate on it’s own, I could see this argument playing out, but I don’t believe that is the case. Like the LinkedIn acquisition in 2016 where Microsoft left LinkedIn alone to operate on their own, Slack should be left alone. Unlike Microsoft and LinkedIn, Slack is a platform with API integration points already built for companies, including Salesforce, which means that it being left alone to operate as a separate entity means something completely different. Salesforce can improve existing integrations and bundle Slack as an offering from a sales perspective, but Slack’s platform nature means that it can maintain a layer of abstraction through it’s APIs to ensure it remains decoupled.

Ideal Integrations and Acquisitions

I am bullish overall on this acquisition and feel that Salesforce made the right call to pay a premium for the developer, integration, and data platform value that Slack has created. Slack also made the right call to look at the competitive landscape, their core offerings, and how they could better position themselves to compete in a very crowded workplace SaaS market against not only Microsoft Teams, but any other new and up-and-coming SaaS startup.

If I were to leave you with one thing it's that “Who got the better deal?” isn’t really the question we need to be asking. In this case, Salesforce was having trouble competing in the communications space while Slack knew that it’s other competitors were growing in strength. Slack and Salesforce will be able to leverage each other’s asymmetries to create the end-to-end workplace tooling that will grow both Slack and Salesforce. They made the deal that’s best for them at the time they needed it.

Hindsight will make people thing they were right or wrong based on the outcome, but as always with these acquisitions, the devil’s in the details on how they operate after the acquisition. Rationalizing them as good or bad will only take you so far, even as the markets try to assess. However, if Salesforce keeps Slack a platform, it’s likely to work out, and it’s just a matter of time before Salesforce dips into its pockets again to buy another SaaS startup like Coda or Notion to fill their quiver.